Automotive electronic systems are increasing in numbers and sophistication, and are including the emergence of new suppliers. This creates opportunities and challenges for semiconductors in both wired and wireless connectivity solutions, and the car manufacturers that integrate them. Here we review the wired connectivity standards in automotive that continue to leverage large investments from the smartphone ecosystem and that should benefit from an increased cross-industry focus.

The automotive standards ecosystem includes standards development organizations (SDOs), mobile and telecommunications organizations (e.g. 3GPP), automotive industry organizations (e.g. 5GAA), and numerous worldwide intelligent transport systems (ITS) organizations. Herein, we focus on another set of standards groups (e.g., MIPI Alliance, JEDEC, and others) that define wired interfaces for chip/device connectivity.

Trends in Automotive

Some of the macro or visible trends in automotive include electrification, connectivity, autonomy, and extended reality:

A. Electrification identifies the transition to battery power (all electric). This is driven by the proliferation of lithium-ion batteries despite alternatives like fuel cells that have been proposed.

B. Connectivity identifies the transition to include multi-radio connectivity, including 4G LTE to 5G mobile broadband, WiFi, and Bluetooth, and is highly leveraged from chips in current smartphones.

C. Autonomy identifies the transition to include a multitude of advanced, yet lower-cost sensors to provide imaging that’s “better than a human,” with 360-degree view and no blind spots. While long-distance radar/lidar derive from conventional automotive technologies, camera sensor technologies are directly leveraged from smartphones, hence they are already generally considered “low cost.”

D. Extended Reality identifies the transition to include augmented reality (AR) and virtual reality (VR) evolved from increasingly high-resolution displays in the information technology (e.g. laptops) and smartphone ecosystems, including heads-up displays (HUD) leading to holograms.

Some of the supporting, less evident trends include reduced chip/device size enabled by ever-decreasing silicon chip geometries and advancing heterogeneous packaging, reduced power consumption enabled by the finer silicon geometries and system-level optimizations, and evolving user engagement where “more touch” is enabled via physical touch interfaces and “less touch” is enabled via wireless, voice, and facial recognition interfaces.

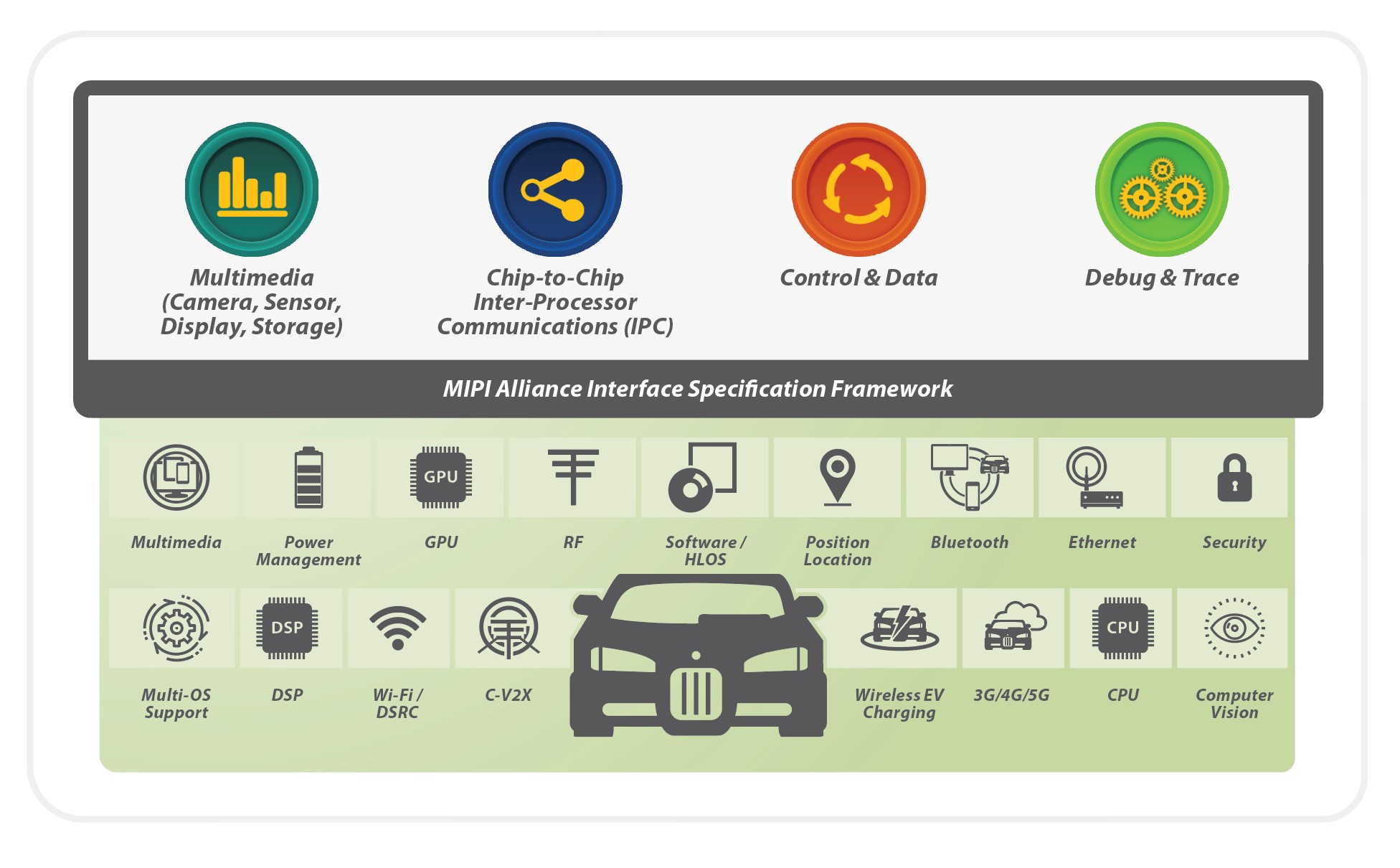

One perspective of the car drawing upon technologies of the smartphone is illustrated in Figure 1. The upper portion depicts four functional categories of interface specifications used in all current smartphones, including multimedia, chip-to-chip inter-processor communications (IPC), control and data, and debug and trace. While these are identified within the MIPI Alliance specifications, other SDOs develop specific interfaces for their areas of interest. Many of these interfaces are already used in cars today, leveraging technologies from the vibrant smartphone ecosystem.

Figure 1: Automotive functions leveraging the smartphone.

However, the automotive industry demands extensions to smartphone technologies, including support for functional safety through the ISO26262 standards, along with the ability to function in a harsher operating environment created by longer cable lengths with electromagnetic interference, compatibility (EMI/EMC) effects, and thermal and vibration effects. Automotive technology also requires a longer lifespan of decades compared with a few years in most smartphones that require silicon operation and replacement over the extended lifetime.

In some regards, one can liken the automotive interface ecosystem to where the smartphone was 15 years ago before MIPI and other SDOs standardized interfaces, and before Google and Apple created their ubiquitous software platforms. As for the smartphone, increased cross-industry standardization can again help with the rapidly developing automotive platform.

High-Speed Connectivity Enables Autonomy

The virtues of autonomy are well described: Coupled with 5G wirelessly-connected smart infrastructure, autonomous vehicles are expected to reduce accidents and fatalities, traverse highways and streets more efficiently, limit traffic jams, and reduce carbon emissions.

While passive safety measures such as seatbelts and air bags may be approaching their potentials, active electronic systems have been implemented for both improved safety and driver assistance. Beyond antilock braking systems (ABS), electronic stability control (ESC), and adaptive cruise control (ACC), newer advanced driver-assistance systems (ADAS) based on advanced sensors are boosting safety and automation, including lane drift corrections, automatic braking, parking assist, and increasing levels of automated driving.

A key focus of wired interfaces for autonomy includes high-speed guaranteed latency/reliability to connect the automation functions of sensing, processing, and acting. The interfaces may also be considered to support engagement with passengers via display systems. Standardization in this area could provide a common interface to improve the economy of scale to reduce cost, which improves the integration of these advanced functions into all car models, from basic to luxury.

However, there are different interface requirements for different functions. For example, many cars support the IEEE 802.3 automotive Ethernet standards that specify a network-based interface backbone shared among many devices, and which is suited for “any-to-any” communications amongst devices, including between many of the “acting” functions. This network sharing may introduce a level of unpredictability in the transmission time or latency/reliability of certain data such as from sensor to processor. Many believe that the increasing performance requirements for the highest speed and guaranteed transmission times for emerging sensors (and display) requirements may make Ethernet less attractive. Partially for this reason, MIPI is developing a simpler point-to-point topology streaming interface known as its automotive physical layer, or MIPI A-PHY, that will support greater speeds for the “sensing” function from sensor to processor. It will also support the high speeds from processor to display. In addition, MIPI A-PHY will support well-known MIPI camera and display protocols used in smartphones today and discussed below.

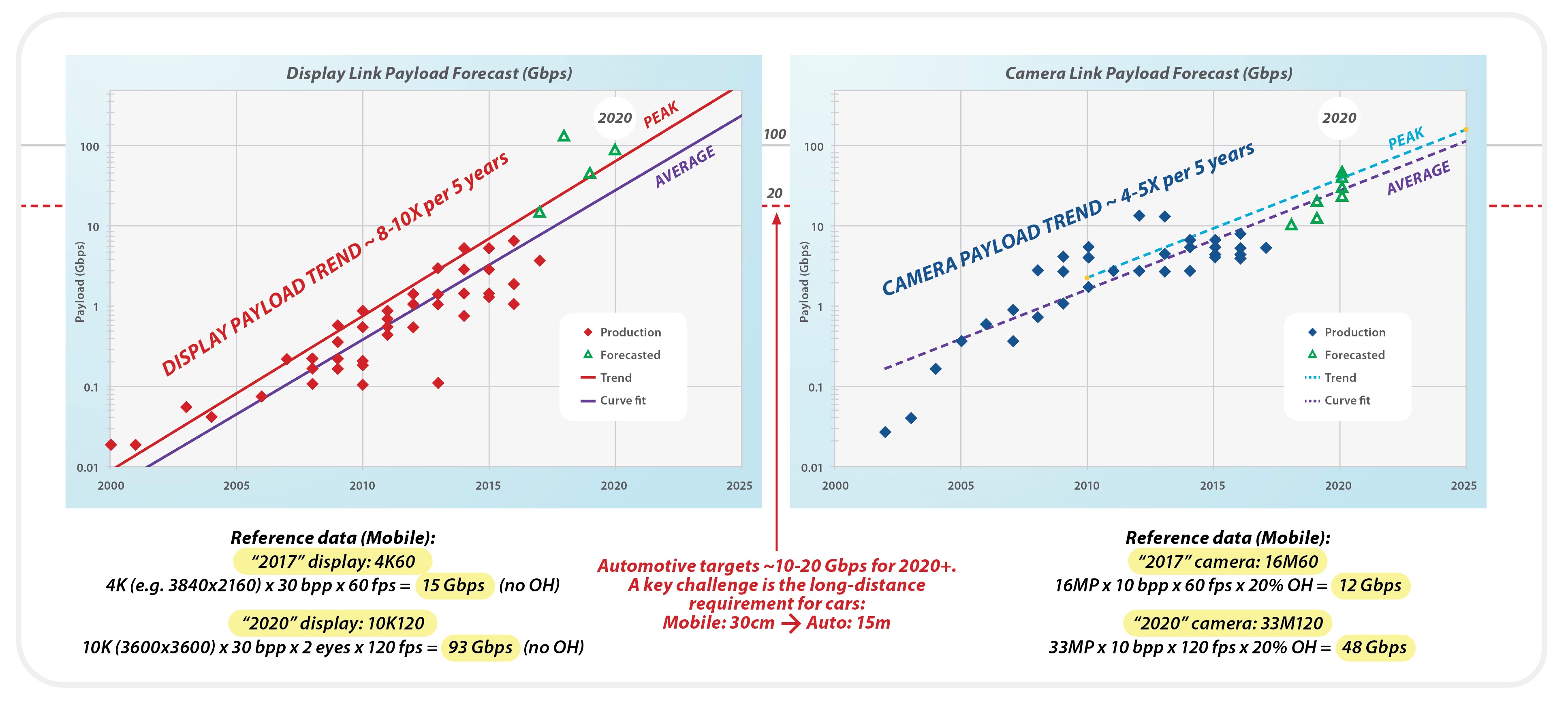

A key interface trend in smartphones supporting 5G is multimedia interfaces for AR/VR in smartphone displays and cameras. Figure 2, provided by MIPI, illustrates the trend in display and camera sensor interface payloads from the pre-smartphone days to 2020 and beyond. This indicates the need for 50-100 Gbps per display interface in smartphones and 25-50 Gbps per camera interface in the 2020+ time frame, largely driven by AR/VR requirements.

Figure 2: Trends in display and camera sensor interface payloads.

Of interest is that the payload demands of display systems outpace cameras by about two-to-one, where display pixel rates have increased by up to 10 times per 5 years, whereas camera rates have increased at about half of that rate, namely up to five times per 5 years. Current VESA display stream compression including the new VESA Display Compression for Mobile (VDC-M) can reduce the display payload speeds by up to a factor of five, which can provide relief to display interface implementations.

Anticipated automotive sensor interface requirements in this time frame are more modest, requiring 10-20+ Gbps. As shown in Figure 2, a 16-megapixel (MP) camera with 10-bits per pixel (bpp) and 120-frames per second (fps) yields 12 Gbps, and parameter modifications can readily increase this by a factor of two. Similar to smartphones, automotive is also expected to require substantially higher data rates for display functions. The automotive interface is complicated by the need for 15 m distances relative to considerable shorter distances needed between smartphone components (e.g. up to 30 cm).

Wired Connectivity Standards in Automotive

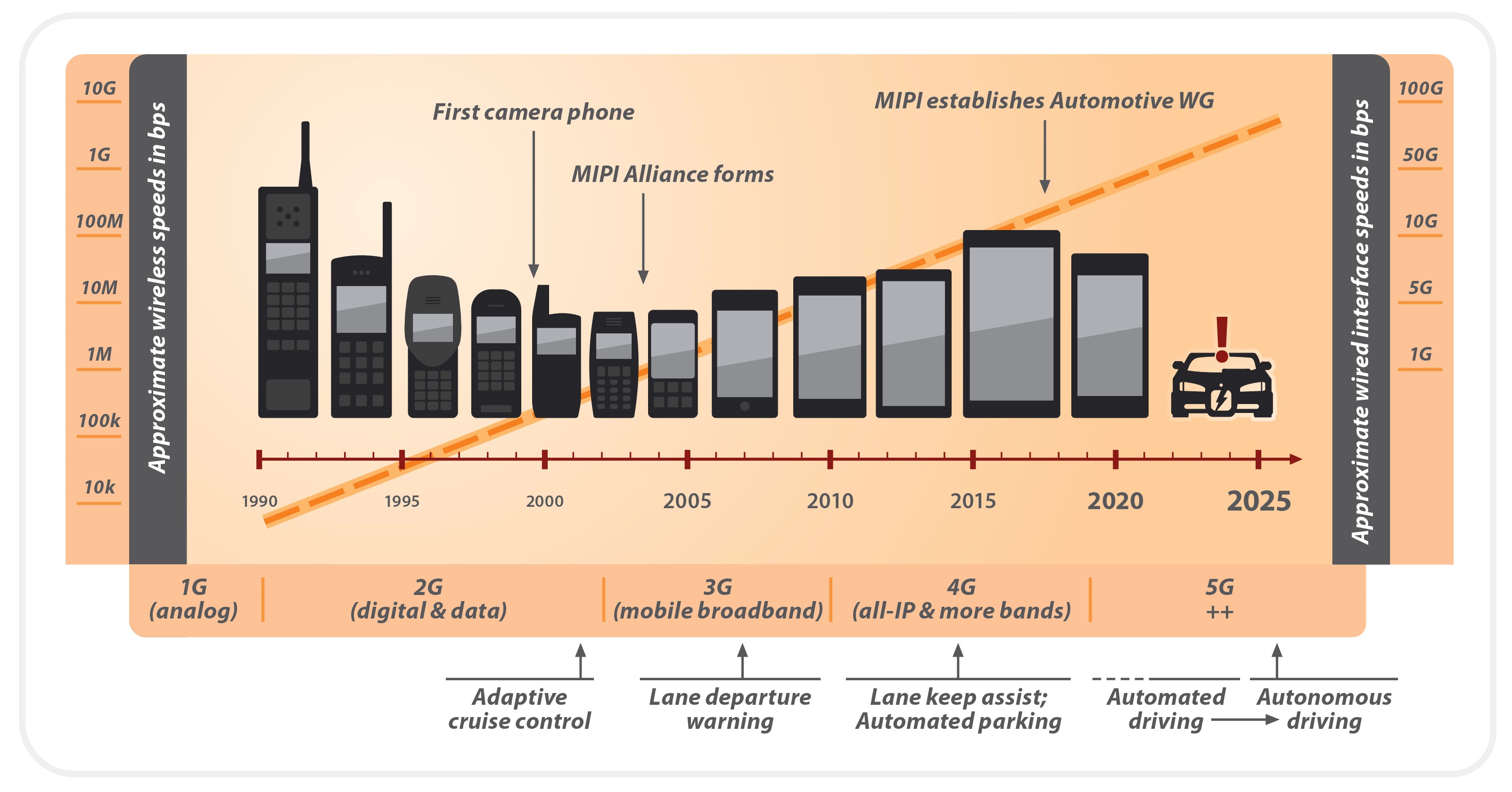

Figure 3 illustrates interface standards evolution across the “mobile Gs,” from early 1G to upcoming 5G, with a focus on MIPI Alliance. It illustrates where MIPI entered the pre-smartphone days to drive the “Gs” wired interfaces, and when its automotive effort was initiated in 2017. Its mission is to continue to support the development of interfaces for 5G and leverage these developments into mobile-influenced markets, including automotive in support of autonomy. Note that the vertical axes represent approximate wireless and wired interface speeds, and where the wired interfaces internal to the device, greatly exceed the wireless interfaces external to the device in the wireless network.

Figure 3: Mobile industry evolution across the mobile Gs.

Many other leading smartphone SDOs are also highly leveraged into automotive. Here we briefly review some of the key wired interfaces SDOs, including MIPI and VESA developing mobile and multimedia interfaces; JEDEC that develops memory interfaces; SD Association (SDA), NVM Express, and related organizations that develop storage interfaces; and PCI-SIG, USB-IF, and IEEE 802.3 that develop high-performance chip-to-chip interfaces. Many of these organizations have specific automotive efforts to leverage their standardization efforts in their native IT, consumer, mobile, and even data center (server) ecosystems.

Mobile and Multimedia

MIPI is the predominant interface specifications body for mobile devices. It takes a “full systems” approach in that it contemplates an entire system design as a broad set of peripherals connected to a host processor via standardized interfaces. Its interfaces are categorized into segments, including multimedia, control, and data. Key multimedia interfaces include its display serial interface (DSI), camera serial interface (CSI), and audio interface (SoundWire). Key control and data interfaces include MIPI I3C for sensor and other peripherals, and the RFFE interface for modem RF front-end control. Many of these interfaces are used in automotive by virtue of their ubiquity in billions of smartphones. MIPI also recently established its Automotive Working Group to define a high-speed interface to support adoption of its interfaces into automotive.

VESA is known primarily for its Display Port (DP) and embedded DP (eDP) interfaces originally used in IT applications including laptops. VESA also standardizes display stream compression methods to reduce the volume of data required by increasingly higher resolution and frame rate displays. Additionally, VESA has recently formed an effort to leverage into the automotive industry.

Memory and Storage

JEDEC is best known for standardizing interfaces for memory and storage, including volatile memories (such as LPDDR and DDR) and non-volatile memories (including NAND and NOR) interfaces. These are used almost by default in most applications, including heavy leverage into automotive. In addition, JEDEC standardizes many package and module specifications for memories and solid-state drives (SSD).

Other SDOs developing storage interfaces include the SDA, known primarily for its near ubiquitous SD storage cards. Recently, the Storage Networking Industry Association (SNIA), Distributed Management Task Force (DMTF), and NVM Express organizations have formed an alliance to coordinate standards for managing SSD storage devices. Generally, these SSD storage devices and interfaces target higher performance and capacity, which may become necessary as the car becomes a mobile server of sorts.

High Performance Chip-To-Chip

PCI-SIG (PCIe), USB-IF (USB), and IEEE (802.3 Ethernet) specify high-performance chip-to-chip interfaces used across IT (laptop), mobile (smartphone), and data center (server) markets. USB can be likened to SD, in that it provides consumers a reuse of a familiar interface, including for charging mobile devices. IEEE 802.3 Ethernet is well known in servers, and given the increasing performance requirements in automotive, has extended there.

Conclusion and the Benefits of Collaboration

Many interface SDOs have initiated efforts to leverage their specific investments for automotive. Likewise, each automotive manufacturer identifies its own specific automotive requirements for its market differentiation. It may be beneficial to accelerate the identification of emerging automotive requirements in a broader setting and identify interface and systems-level options to meet a common understanding of emerging requirements. This exercise may help reveal the tradeoffs of various selections, such as selecting a display interface, camera sensor or display interface, storage interface, or even system-level topologies such as centralized or network-centric.

As was the case when MIPI organized key phone manufacturers in 2003 to begin its interfaces development, a similar collaborative approach to automotive requirements may help to instruct each organization’s roadmap and accelerate the growth of the automotive platform, including the roadmap to autonomy. This is complicated by the specific practices across SDOs and industry organizations, so if pursued, the proper engagement structure should be determined.