Designers have choices when it comes to creating new IoT designs; connectivity choices depend on the design’s constraints. As with any engineering decision, the learning curve and time-to-market constraints can dictate OEMing an existing solution to the problem.

Design engineers have choices on every level. Do we buy modules or boards or design the functions in-house? Do we use digital or analog signal processing? What microprocessor/microcontroller and architecture do we employ? Every decision has benefits and consequences.

Companies have core competencies in their specialty but often must make decisions regarding a device’s connectivity. As the technological players reshuffle the board, connectivity comes to the front, especially along the network edge. For example, do we use the newest 5G chipsets and go with 5G connectivity, or do we employ a lower-power wireless LAN technology capable of wide-area coverage that can reach all the devices at the edge?

Why all the focus on connectivity?

In a word: money. Wireless carriers charge a fee for every connected device and the number of IoT devices is growing rapidly. Global wireless carriers needed three decades to reach the current 2.3 billion subscribers. In the few years that IoT services have been available, more than 8.4 billion IoT devices have been connected. Now, at least 20 billion are connected. Even though not all IoT devices directly connect to the internet, only 10 billion of them would still create immense annual revenues for service providers. This influx of connectivity can be a huge revenue opportunity. IoT applications, however, have broad differences. The current capabilities of cellular-based and low-power wide-area network (LPWAN) applications differ such that no single standard will satisfy every need.

The choice of connectivity will depend on the constraints of the design. These include, but are not limited to:

- Cost

- Time to market

- Size

- Power

- Range

- Data rates

- Reliability

- Security

- Latency

- Ruggedness

- Expandability

Another factor is the cost burden to customers. If you require every IoT device in a small area to have a cellular connection, the cost of use can skyrocket. By the same token, if you need multiple aggregators and base stations to make your wide-area network function, that can also dissuade customers. Right off the bat, the constraints that your IoT-connected devices are sensitive to will steer your choices.

The cellular industry has unique advantages for IoT. Carriers already have almost ubiquitous LTE coverage in the U.S. delivered by several hundred thousand macro base stations and perhaps three times that many small cells. In most cases, updating this infrastructure to accommodate communication with IoT devices requires just a software upgrade rather than a significant investment in hardware. In addition, even before IoT became the next big thing, wireless carriers provided connectivity to wireless-enabled sensors using 2G technology. Although 2G and 3G services are disappearing, 4G and 5G are available.

The industry has worked for years to accommodate IoT. 3GPP has included substantial specifications dedicated to IoT. Now at Release 17, the protocols and standards under its umbrella include GSM 2G and 2.5G standards, UMTS 3G standards, LTE Advanced and LTE Pro 4G standards, 5G NR, and an evolving IP Multimedia Subsystem (IMS) as an access independent medium.

In contrast, low-power wide-area network (LPWAN) providers started with no such advantages. Because they were new entities, they needed to build every system in every area where coverage is desired. They have also had a limited time deploying these networks in key (typically urban) areas, as the cellular industry is rapidly rolling out its IoT-centric data plans. Fortunately, LPWAN systems are less expensive to build and deploy than cellular networks, do not always require leasing space on a tower, and cover wide geographical areas with fewer base stations. They also have the advantage of allowing proprietary solutions that can create the branding of function into the unlicensed RF bands.

The question persists whether LPWAN providers can survive in a cellular-dominated world. Most analysts believe they will offer similar capabilities to cellular networks, such as carrier-grade security and other mandatory features. They can become cost-competitive for customers as well. Analysts also suggest that at least half of IoT use cases can be served by LPWANs. It’s a relatively safe bet that, while the cellular industry will have a commanding presence in delivering IoT connectivity, LPWAN providers will still find room in what is likely to become a price war within individual markets.

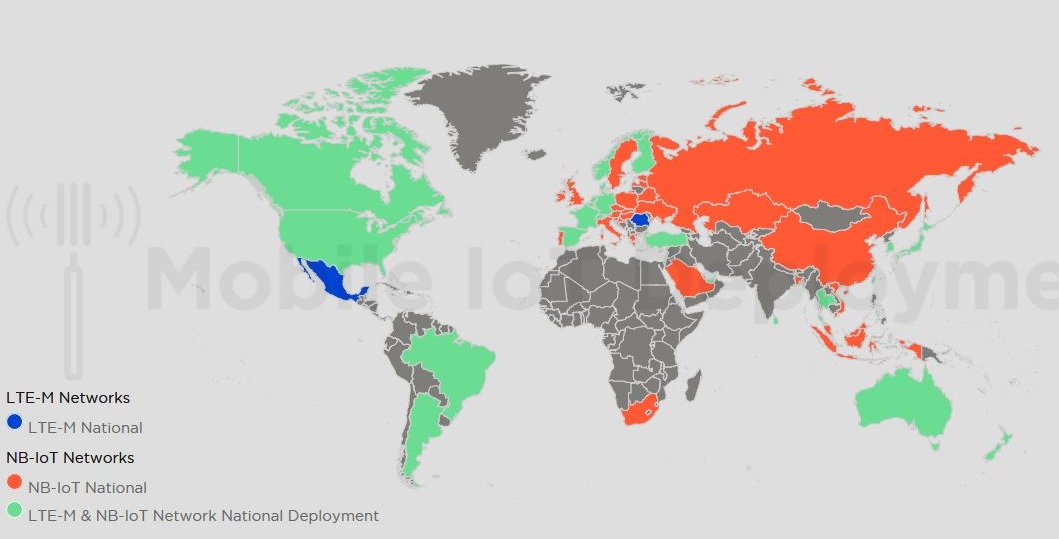

Three standards seem to be emerging as viable choices to the engineering community at large. The market leaders so far are Long-Range Wide-Area Network (LoRaWAN), Narrowband Internet of Things (NB-IoT), and Long Term Evolution for Machines (LTE-M) standards. Others are, however, clawing their way into the visible ecosystem. LTE-M and NB-IoT have gained a foothold in North America, South America, parts of Europe, and Australia. NB-IoT has gained acceptance in Russia, China, and South Africa. LTE-M is establishing itself in Mexico and parts of Europe. But all are in play anywhere (Figure 1).

Figure 1. The LPWAN standards vary from continent to continent and from country to country. In any case, aggregators and access points will allow internet connectivity regardless of the LPWAN standard used in a specific location. Image: GSMA

For large-scale deployment of relatively simple distributed sensor systems, LPWAN features low costs, long-range transfers, low power (coin cells can last for years), and sufficient throughput for simple and tokenized applications. For example, an array of wind speed, direction, temperature, and humidity sensors deployed over large continental areas might not have cellular coverage, especially in sparsely populated areas. This non-data-intensive information can be optimized to use time slots or polled operations. Each sensor can measure and log data at predetermined intervals. Because data values are simple short numeric values, low data rates over long distances are desirable, with low-power operations so batteries will last for years.

A lot will hinge on whether cellular coverage is available in a remote area. Although cellular services can provide longer ranges than Bluetooth, Bluetooth Low Energy (BLE), ZigBee, Wi-Fi, and other short-range protocols, LPWAN still has the advantage of the longest range in remote areas where there’s no cellular coverage.

A good choice for this application could be LoRaWAN. The narrow 125 kHz bandwidth supports 50 kb/sec data rates, which are sufficient to transfer low-power bursts of data over long distances. The 915 MHz frequency band offers many competitive component suppliers to help lower costs. Battery estimates of five to ten years are feasible. The Chirp Spread Spectrum (CSS) modulation technique is robust and relatively immune to noise, especially if channel selections can be made by measuring the best choices at specific locations. No cellular support is needed to implement this standard. LoRaWAN does not require license fees and uses an unlicensed spectrum.

Figure 2. This Mikroe 5G NB-IoT Click board uses a module to add wireless connectivity. Image: Mikroe

Applications that need higher data rates can use LPWANs that link to cellular services if available at specific locations. NB-IoT and LTE-M LPWAN standards, which operate in a subset of the LTE bands, can have very long ranges because they link to cellular and even cloud services. The NB-IoT features 100 kb/sec data rates using 180 kHz bandwidths because of QPSK and BPSK modulation. Battery life can potentially be ten or so years. The LTE-M standard increases the data rate to 370 Kb/sec using a 1.08 MHz channel bandwidth and quadrature amplitude modulation (QAM). Note, LTE-M channels can support voice. This can be a nice feature when debugging a sensor in a remote area. Figure 2 shows an NB-IoT board that uses a module to add connectivity.

Cellular and 5G IoT

The cellular industry is developing technologies for IoT connectivity based on LTE. The industry’s overall roadmap is to build on LTE’s current versions and continue to refine them, including reducing their complexity and cost. As this process unfolds, cellular technology will become better suited to a wider variety of IoT applications, ultimately leading to the introduction of 5G, the fifth generation of cellular technology.

To achieve this goal, the industry consensus appears to be based on three standards primarily introduced in 3GPP Release 13, ultimately resulting in what is included in the 5G standards. These solutions should ideally be implemented at frequencies below 1GHz where propagation conditions are more conducive to longer-range and building penetration:

- LTE-M: Stands for Long Term Evolution for Machines, also called enhanced Machine Type Communication (eMTC). This is a cellular-based low-power wide-area network developed by 3GPP. Several releases are under this umbrella ranging from 1 Mb/sec to 10 Mb/sec download rates and 1 Mb/sec to 7 Mb/sec upload rates. Operating in half duplex or full duplex, the newer releases feature 10 ms to 15 ms of latency compared to 50 ms to 100 ms latency for older technology.

- NB-IoT: A narrowband version of LTE for IoT also developed by 3GPP. It used the same sub 6 GHz spectrum as 4G LTE and was designed with IoT in mind. It is claimed that IoT devices using the half-duplex NB-IoT can run for decades on battery power, but this will depend on your design. It does include power-saving features such as power-saving mode (PSM) and extended discontinuous reception (eDRX). It uses adaptive modulation and an interesting repeater functionality called hybrid automatic repeat request (HARQ) to take advantage of narrowband transmission signaling. Up to 1 million NB-IoT devices can connect within a square kilometer. Data rates are up to 127kb/sec download and 159 kb/sec upload.

- EC-GSM-IoT: Extended Coverage-GSM for IoT is an extended coverage variation of Global System for Mobile Communications technology optimized for IoT in Release 13 and can be deployed along with a GSM carrier. It can optimally achieve 2 Mb/sec upload and download rates but can drop to 474 kb/sec along the edge. The half-duplex protocol standards have long latencies, 700 ms to 2 sec, so real-time reporting and control are not recommended.

- 5G: Chipsets for 5G are evolving now. Large-scale, high-volume manufacturers such as Samsung and Apple have grabbed these parts and will get application support and mindshare from device makers. Still, this technology will find its way to the bulk of the engineering community and will find its way onto PC boards designed for IoT functions. Although blazing speeds (peak 20 Gb/sec) and low latency (1 ms compared to 200 ms with 4G) are features of the 5G embedded designs, connectivity service charges are a part of this solution’s requirements. This adds up quickly as many 5G-based IoT devices come into service.

Leading the Pack

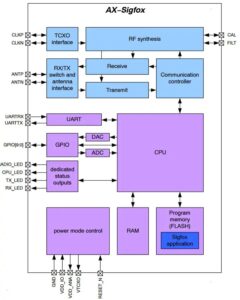

Figure 3. Functional block diagram of ON Semi’s AX−SigFox transceiver IC, which connects to the customer product using an RS232 UART operating at TTL logic levels. It uses AT commands to send frames and configure radio parameters. Image: ON Semi.

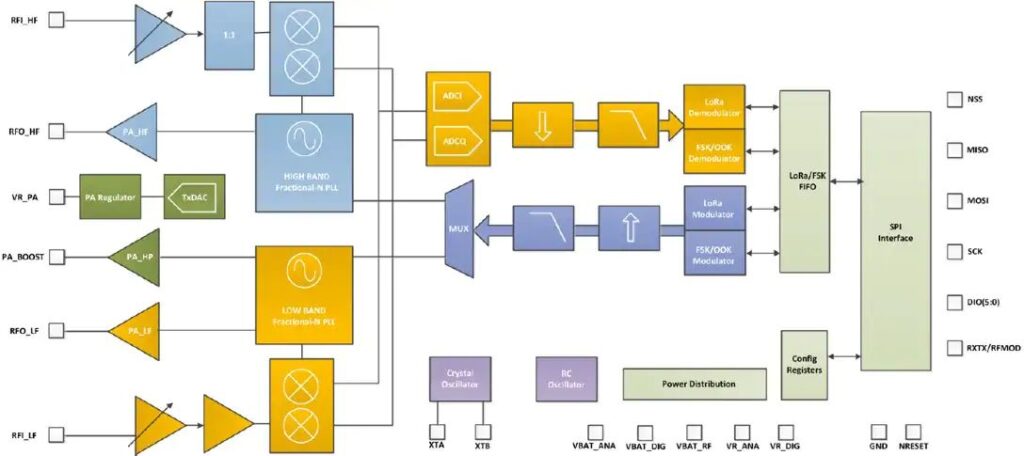

The unlicensed LPWAN technologies have an advantage over licensed versions, and the two leading the pack are LoRaWAN and Sigfox. Sigfox provides end-to-end connectivity using its proprietary architecture and ecosystem but it lets endpoint devices use its technology for free if device manufacturers adhere to the Sigfox rules. Figure 3 shows a diagram of the Semtech SX1275 architecture. Figure 4 shows a Sigfox USB dongle.

It’s important to differentiate LoRa, LoRaWAN, and offerings by Link Labs, as it can be a bit confusing. LoRa is the physical layer of the open standard administered by the LoRaWAN Alliance, while LoRaWAN is the Media Access Control (MAC) layer that provides networking functionality. LinkLabs is a member of the LoRaWAN Alliance that uses the Sematech LoRa chipset (Figure 5) and provides Symphony Link connectivity that has features unique to the company, such as operating without a network server. Symphony Link uses an eight-channel base station operating in the 433 MHz or 915 MHz Industrial, Scientific, and Medical (ISM) bands and the 868 MHz band used in Europe. It can transmit over a range of at least 10 miles and backhauls data using Wi-Fi, a cellular network, or Ethernet though a cloud server to handle message routing, provisioning, and network management.

Newer players such as Symphony Link and Ingenu RPMA are overcoming some of the limitations of Sigfox and LoRaWAN. Expect to see more players in this space and cloud and infrastructure services emerging from cellular and non-cellular solutions.

An interesting anomaly in the IoT connectivity universe is Weightless. Weightless is an anomaly among IoT connectivity solutions; it was developed as a truly open standard managed by the Weightless Special Interest Group (SIG). It gets its name from its lightweight protocol that typically requires only a few bytes per transmission. This makes it an excellent choice for IoT devices that communicate very little information, such as some types of industrial and medical equipment, as well as electric and water meters.

Figure 5. The Semtech SX1276 Low Power Long Range Transceiver functional block diagram. Image: Semtech.

Unlike many other standards, Weightless operates in the so-called T. white spaces below 1 GHz that were vacated by over-the-air broadcasters when they transitioned from analog to digital transmission. As these frequencies are in the sub-1 GHz spectrum, they have the advantages of wide coverage with low transmit power from the base station and the ability to penetrate buildings and other RF-challenged structures.

Weightless comes in two versions:

- Weightless-N is an ultra-narrowband, unidirectional technology.

- Weightless-P is the company’s flagship bidirectional offering that provides carrier-grade performance and security with extremely low power consumption and other features.

Another interesting player to watch is Nwave, an ultra-narrowband technology based on software-defined radio (SDR) techniques that can operate in licensed and unlicensed frequency bands. The base station can accommodate up to 1 million IoT devices over a range of 10 km with RF output power of 100 mW or less and a data rate of 100 b/sec. The company claims that battery-operated devices can operate for up to 10 years. When operating in bands below 1 GHz, it takes advantage of the desirable propagation characteristics in this region.

Also, be aware of Ingenu. Formerly called On-Ramp Wireless, Ingenu has developed a bidirectional solution based on many years of research that resulted in a proprietary direct-sequence spread spectrum modulation technique called random phase multiple access (RPMA). Designed to provide a secure wide-area footprint with high capacity, RPMA operates in the 2.4 GHz band.

A single RPMA access point covers 176 mi² in the U.S., significantly greater than either Sigfox or LoRa. It has minimal overhead, low latency, and a broadcast capability that allows it to send commands simultaneously to many devices. Hardware, software, and other capabilities are limited to those provided by the company, and the company builds its public and private networks dedicated to machine-to-machine communications.

Close to the Edge

As more devices and services connect to the internet, refinements and enhancements will emerge. As with any engineering decision, the learning curve and time to market constraints can dictate OEMing an existing solution. As the number of nodes increases, the prices should drop.

A parallel approach allows OEMing a canned solution while developing your own. Already, antennas, filter networks, and assorted components for hardware are available. The sheer number of expected IoT connections makes this technology one that will be around for a long time. Climbing the learning curve can be desirable, even for smaller, narrowly focused companies.

We see ransom hackers disrupting normal operations of everything. So, think twice about how to manage security across the worldwide distribution of your IoT designs. Leave room for a backup plan.

Lastly, remember that various sources plan to put 262,000 Wi-Fi satellites around the globe. Although this might provide connectivity everywhere, it will still be a pay-per-connection technology.

Tell Us What You Think!