Part 2 continues the theme of power and efficiency in amplifiers, adding upload links, fixed access, and open RAN.

In part 1, Naveen Yanduru, Vice President and General Manager, Renesas Electronics, Shahriar Shahramian, Director, Bell Labs, and Dr. Ir. Michael Peeters, Program Director Connectivity, IMEC discussed some of that’s needed to keep 5G on track and what’s needed in terms of improvements. Even as 5G is being deployed, R&D continues unabated. While 5G works, it needs to become more efficient in terms of power consumption, fiber reach, spectral efficiency, and reduced costs. In part 2, we’ll cover discussions from Bami Bastani, Senior Vice President, RF Business Unit, Globalfoundries, David Pehlke, Senior Director of Systems Engineering, Skyworks, James Chen, Associate Vice President, MediaTek, and Chih-Lin I, China Mobile Chief Scientist, Wireless Technology, China Mobile.

Bami Bastani from Globalfoundries looked at 5G from a semiconductor perspective, noting that 5G deployment is still very much on track despite COVID-19. Handsets that support 5G FR1 are driving growth. “5G comes into play where we need high data rates without wireline connections. 5G needs to increase network capacity by 100 times with 100 times better efficiency and 10 times better latency than the 4G we have today.”

“5G will create more than just faster downloads,” he said. “An autonomous vehicle generates 3.6 TB of data per hour. We will need ultra-low latency to support that.” Computing will move to the network edge to reduce latency. AI will assist in reconfiguring networks to adapt the changing data traffic and computing needs. “All of these issues are driving the need for low-power semiconductor technologies,” a theme repeated through this summit.

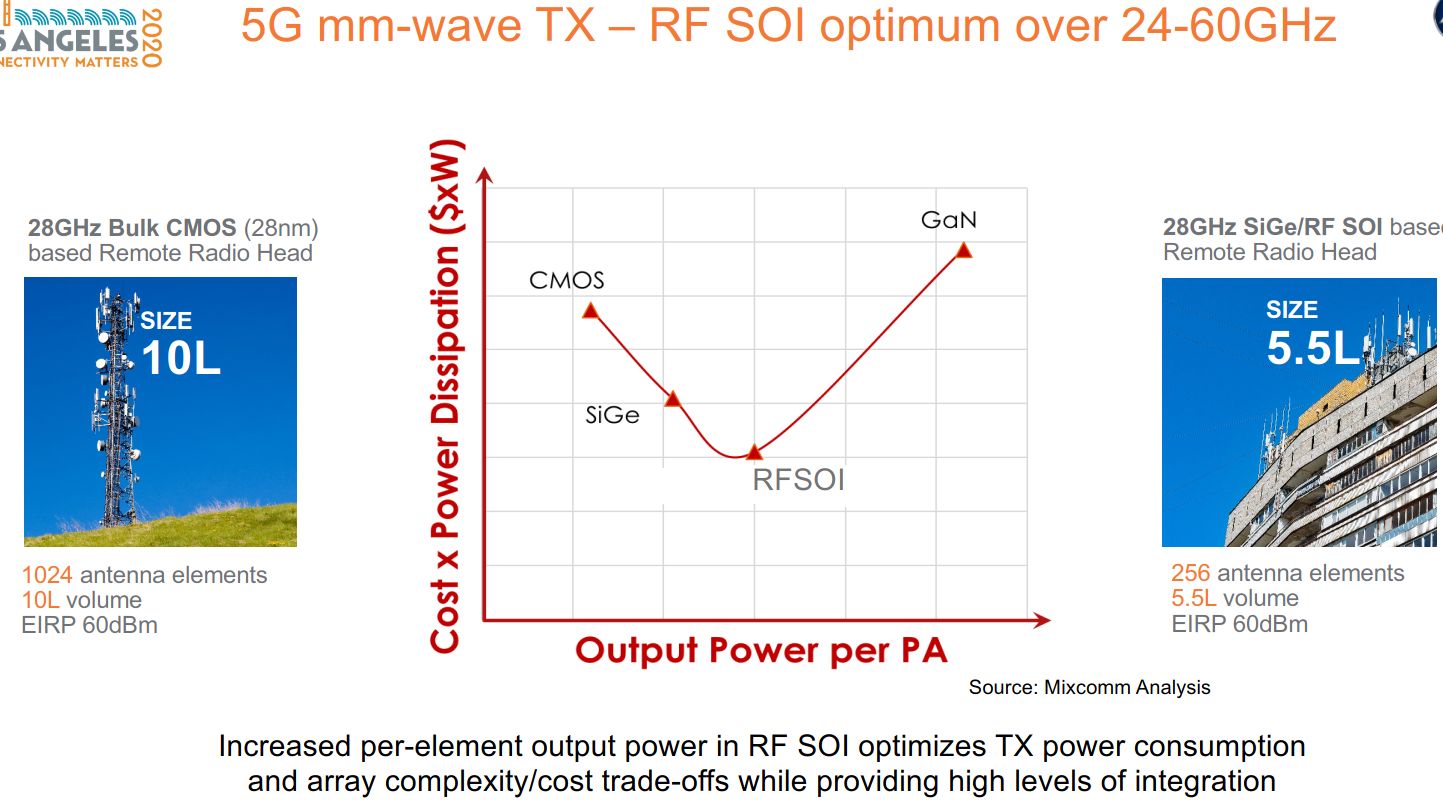

Bastani noted that 5G networks and the devices that connect to them will be “always on” and the semiconductor technologies need to be reliable and power efficient. Several options for semiconductor technologies have emerged for 5G mmWave transmitters. Each comes with tradeoffs. Bastani pointed to RFSOI as a promising technology, citing power per PA and cost. Figure 1 shows an RFSOI design developed at Georgia Tech. According to Bastani, this design reduces the number of antennas by a factor of four, reducing cost, power, size, and weight.

Figure 1. RFSCI technology shows promise in power and cost of 5G power amplifiers. Source: IMS2020/IEEE.

While he cited efficiency in bulk CMOS, he noted increased costs due to a greater number of antennas needed for beamforming. That increases cost and size of the base station equipment. RFSOI, now moving into its second generation, is increasing integration of low-noise amplifiers and power amplifiers.

David Pehlke of Skyworks covered RF front ends (RFFEs) for 5G radios. He covered higher data rates, power, cost, and number of antenna elements needed at sub-7 GHz. The RFFE’s need to support both 5G and 4G and at many frequency bands within the sub-7 GHz range.

Pehlke continued the discussion surrounding the need for using less power. While most 5G radio discussions focus on downlinks, there’s more to 5G than download speeds. The uplink needs stability to maintain a connection.

Issues surrounding RFFEs include the wider channel bandwidth — 100 MHz and even wider in some specialized applications. The wide bandwidths wreak havoc on envelope tracking. Reinforcing what Naveen Yanduru said in part 1, Pehlke said “The transmit engine has to fundamentally change. Analog tracking is good only to about 60 MHz of channel bandwidth. Digital envelope tracking and other schemes have been developed to address the problem. It’s an exciting time.”

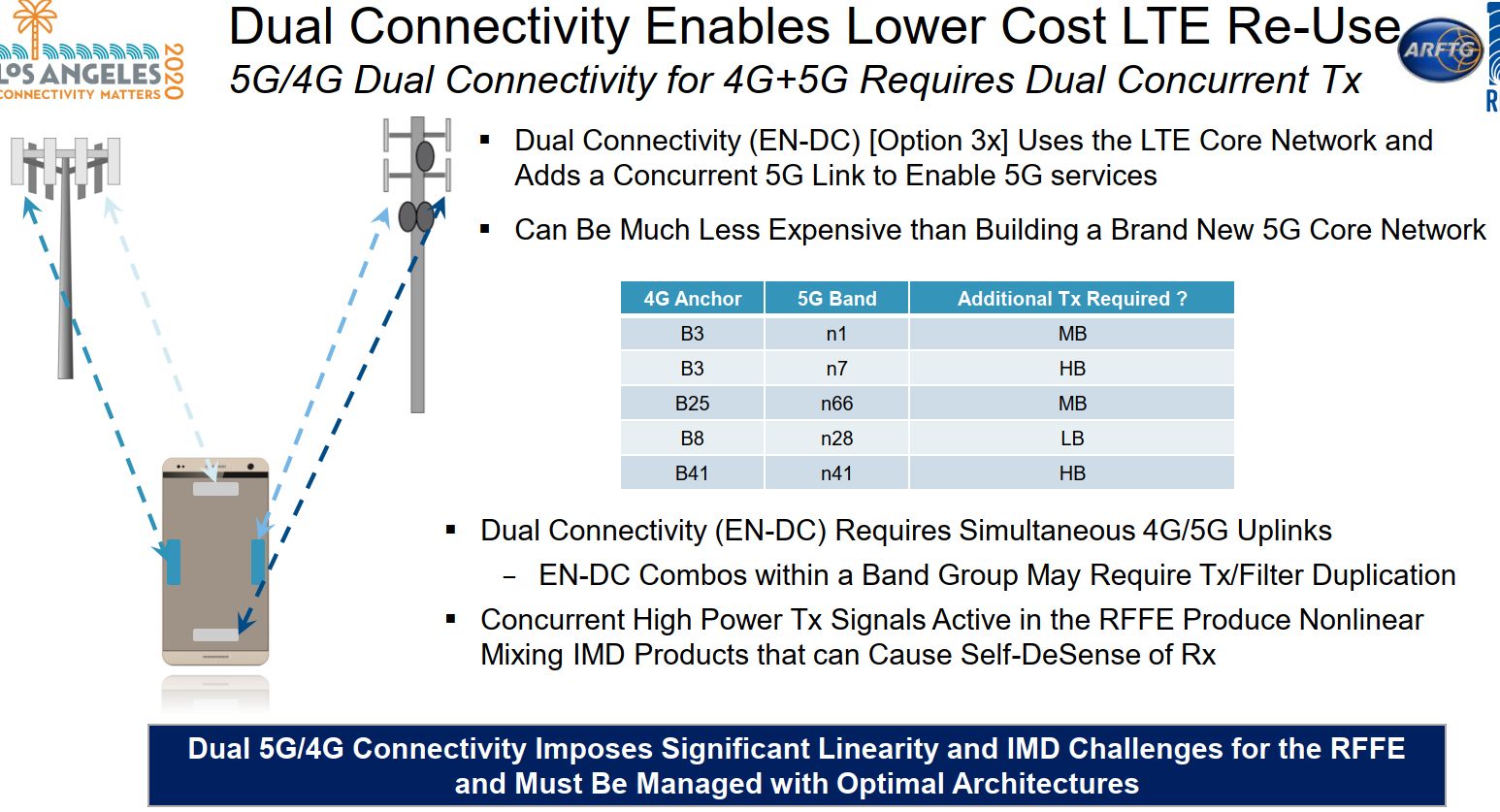

While it seems obvious, handsets and other user equipment will need dual 4G/5G connectivity for years to come (Figure 2). A challenge for engineers comes in supporting carrier aggregation and 4×4 MIMO.

Figure 2. Dual 5G/4G connectivity creates problems such as linearity, interference, and antenna placement. Source: IMS2020/IEEE

Pehlke continued by noting that there’s plenty of opportunity for innovation in the 3.5 GHz to 5 GHz spectrum. The same goes for the unlicensed 5 GHz and 6 GHz Wi-Fi bands. Beam steering and mmWave frequencies, with shorter wavelengths, are easier to fit into handsets than is possible at lower frequencies. Even so, dual connectivity with 4G and sub-7 GHz frequencies is critical to the design into low-cost phones, particularly in parts of the world that won’t see 5G for years.

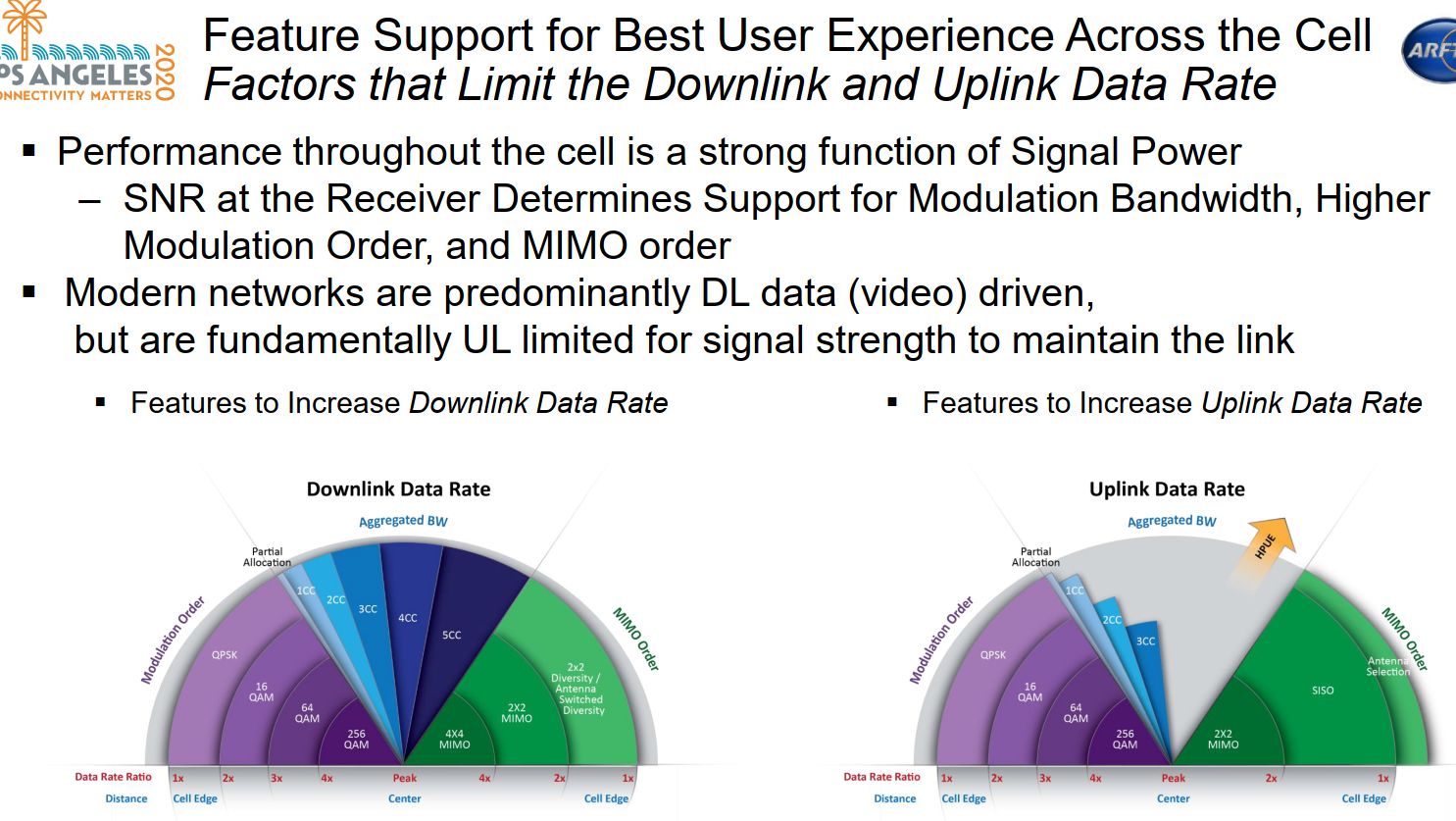

Modulation is another issue with 4G/5G connectivity. Looking at Figure 3, you can see that as you approach the edge of a cell’s coverage area, a wireless device’s modulation order needs to change to maintain connection. The signal strength simply won’t support 256 QAM with 4×4 MIMO at the cell edge. Modulation could drop to QPSK with fewer or no aggregated carriers.

Figure 3. Modulation and carrier aggregation drop as distance from the cell transmitter increases. Source: IMS2020/IEEE.

Pehlke presented several plots showing how signal quality degrades, but he also showed how the modulations introduced with 5G have better signal-to-noise ratio (SNR) that those used in LTE. While those improvements range from 1 dB to 2 dB, that’s still enough to result in a reduction of output power for a given signal strength. Uplinks are more of a challenge in terms of network coverage than downlinks because of restrictions on signal power.

Cyclic Prefix Orthogonal Frequency Division Multiplexing (CP-OFDM) is new for 5G uplinks, though it’s used for downlinks in LTE. The received power can be up to 2 dB better than Discrete Fourier Transform-spread-OFDM (DFT-S-OFDM). In addition, new waveforms that feature approximately 2 dB peak-to-average power ratio (PAPR) have been introduced. These waveforms are essential for mmWave communication to operate efficiently.

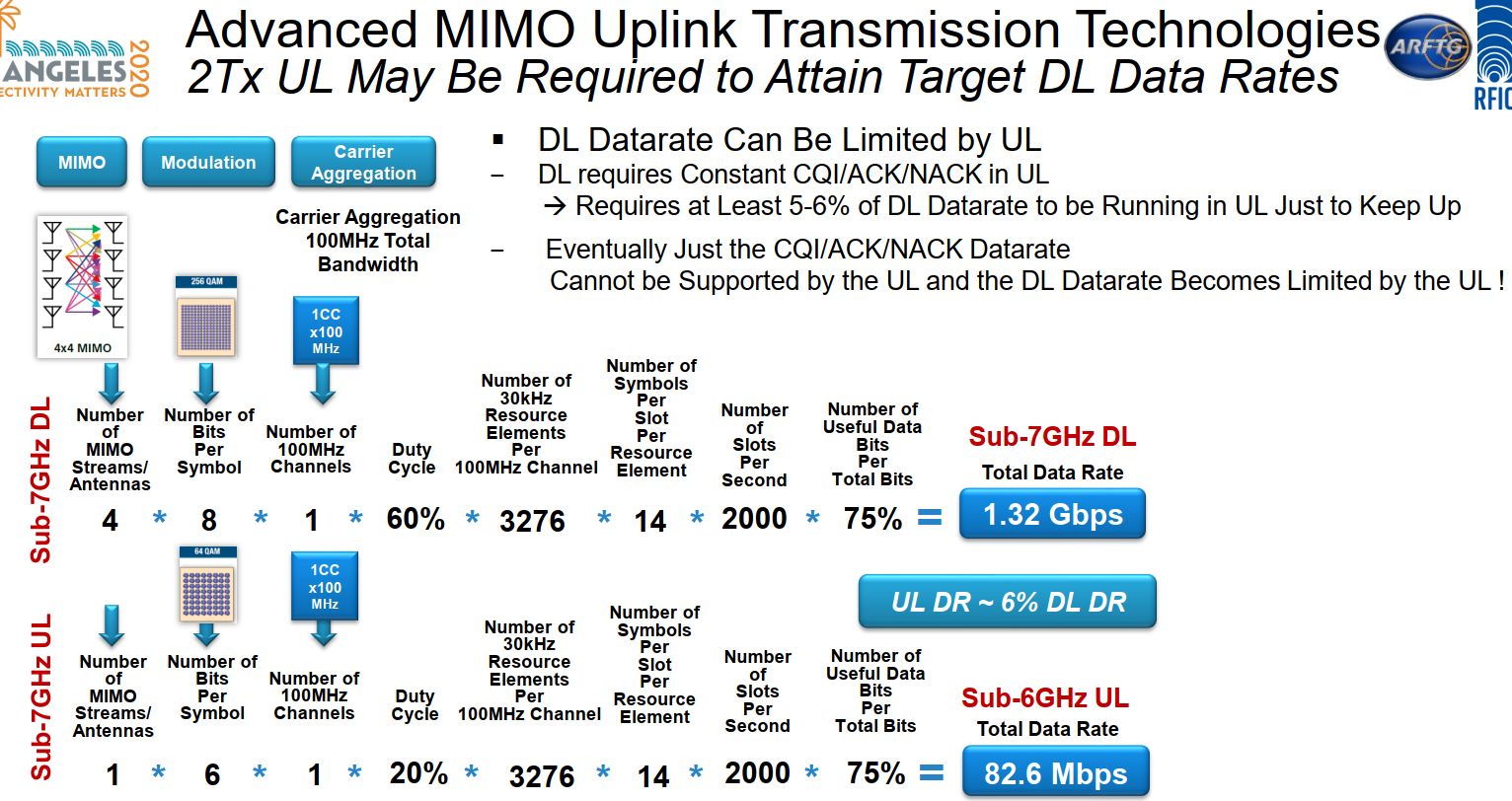

Pehlke also described the antenna requirements for supporting both LTE and 5G, with emphasis on the uplink. He described antenna switching and placement. That’s because sounding reference signal (SRS) antenna switching is recommended, with a handset using two transmit and four receive antennas while certain bands require 4×4 MIMO. Figure 4 shows how 5G uses MIMO, modulation, and carrier aggregation to calculate the uplink and downlink data capacity.

Figure 4. MIMO, modulation, and carrier aggregation all have an effect on data rates. Source: IMS2020/IEEE

James Chen of MediaTek looked at the many technologies of 5G and how they are being adopted around the world. “All 5G are not created equal.” There are differences. Chen focused on customer-premise equipment (CPE) where he sees more than just mobile phones.

Chen also looked at 5G providing home internet access, which was the original rollout intent for 5G before mobile catapulted to the top. He sees CPE as replacing fiber internet access without using mmWave. The longer range of low-band and mid-band signals will make it possible.

In covering the deployments and frequencies used in 5G, Chen noted that 5G uses much of the 4G network, but with the goal of becoming a stand-alone network. Dynamic spectrum sharing at 3.5 GHz is one such way that 5G uses the 4G infrastructure. Carrier aggregation is another technology shared by 5G and LTE. For example, LTE and 5G FR1 carriers could be aggregated. So can LTE with 5G FR2. FR1 FDD and TDD signals can also be aggregated. FDD at 850 MHz is a popular band that gets aggregated. Chen claims to have seen some 250 combinations of carrier aggregation. “That’s good if you’re in the RFFE business.”

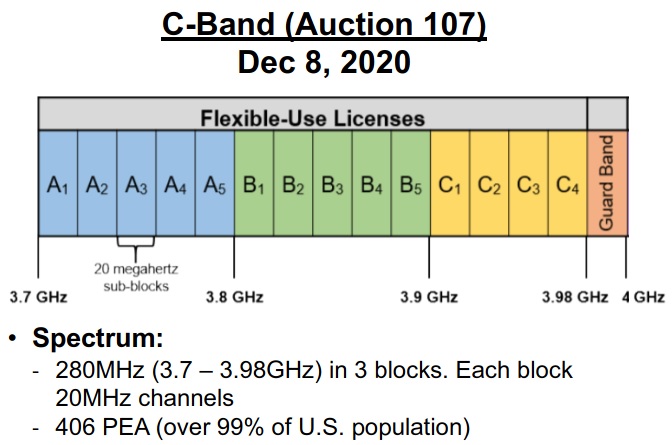

The upcoming C-band auction (3.3 GHz to 4.2 GHz). The auction (Figure 5) will start with band n77, 3.7 GHz to 4.2 GHz (TDD). It’s a tradeoff between bandwidth and reach. “There’s a total of 280 MHz of spectrum to be auctioned,” said Chen, “It’s not mmWave and thus doesn’t have the propagation issues. Channel bandwidth will be 20 MHz.”

Figure 5. An upcoming FCC spectrum auction will add 280 MHz to wireless communications. Source: IMS2020/IEEE.

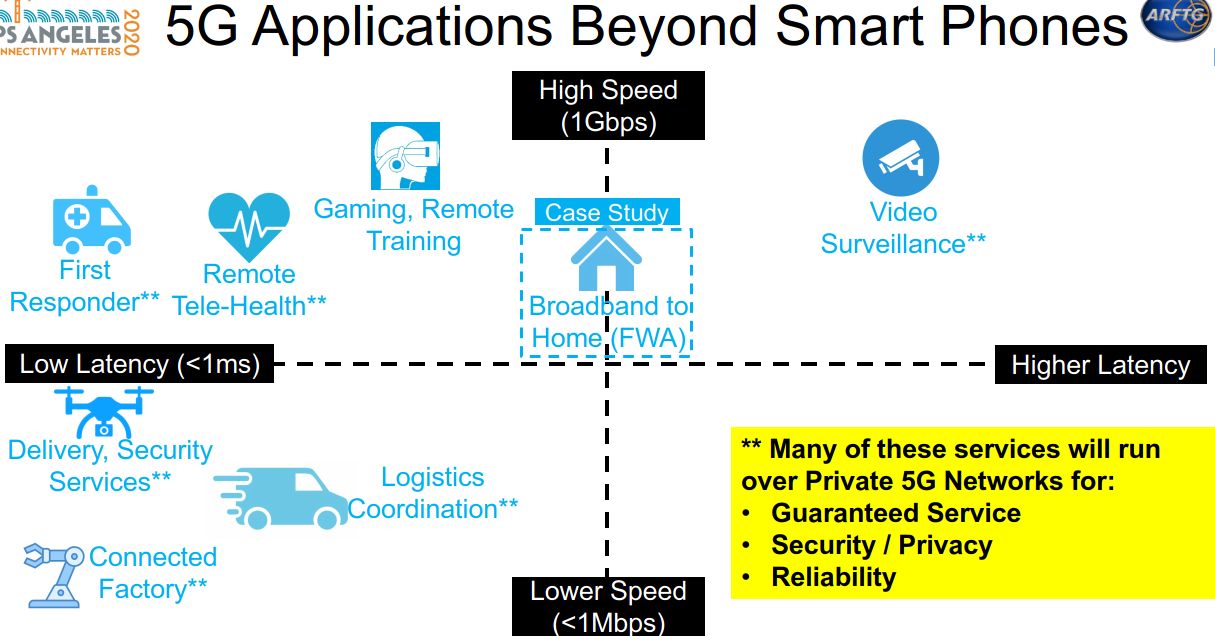

Chen looked beyond mobile phones as applications of 5G. Figure 6 shows applications relative to data rates and latency. He focused on the center, fixed wireless access to the home. “People have deployed 3G and 4G networks for these applications, but it really makes sense with 5G. Furthermore, COVID-19 has shown that there are 25% to 30% of 130 million homes in the U.S. that lack broadband internet access.” Broadband is defined as anything over 25 Mbits/s. Personally, I know plenty of people who have DSL or basic cable internet that operate below 25 Mbits/s who are quite happy with it.

Figure 6. Fixed wireless access for home internet could reach where wired connections don’t. Source: IMS2020/IEEE.

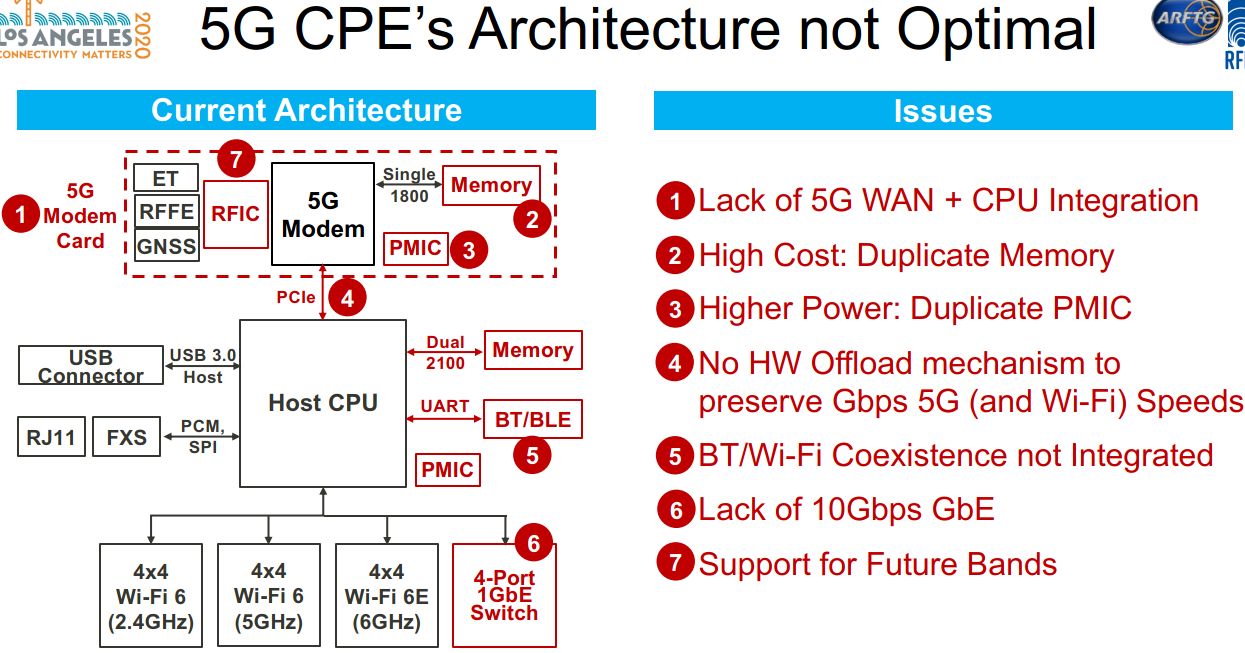

Chen claims that there are many locations where wireline hasn’t penetrated. Mobile operators will go into those areas. Chen also sees many business applications that will use 5G-connected equipment. In Figure 7, Chen shows that the architecture of today’s CPE is too complex and costs too much.

Figure 7. More integration is needed to lower the cost and power consumption in customer premises equipment (CPE). Source: IMS2020/IEEE.

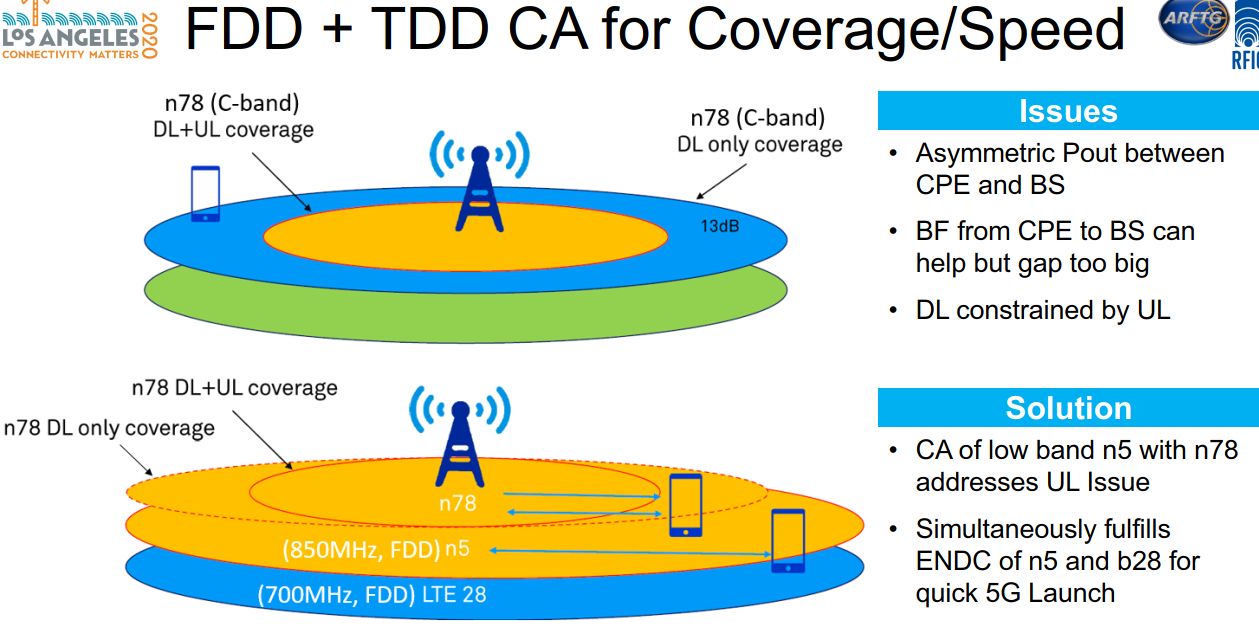

Chen cites a lack of integration as the reason for slow adoption of 5G CPE. “Smartphone ICs as a stand in for CPE isn’t going to work.” He also claims that we don’t have enough low-band and mid-band spectrum to cover those applications. His solution: use carrier aggregation to bond FDD from the lower frequencies with TDD in the higher FR1 spectrum (Figure 8).

Figure 8. A combination of FDD and TDD addresses transmission issues, particularly in the uplink. Source:IMS2020/IEEE.

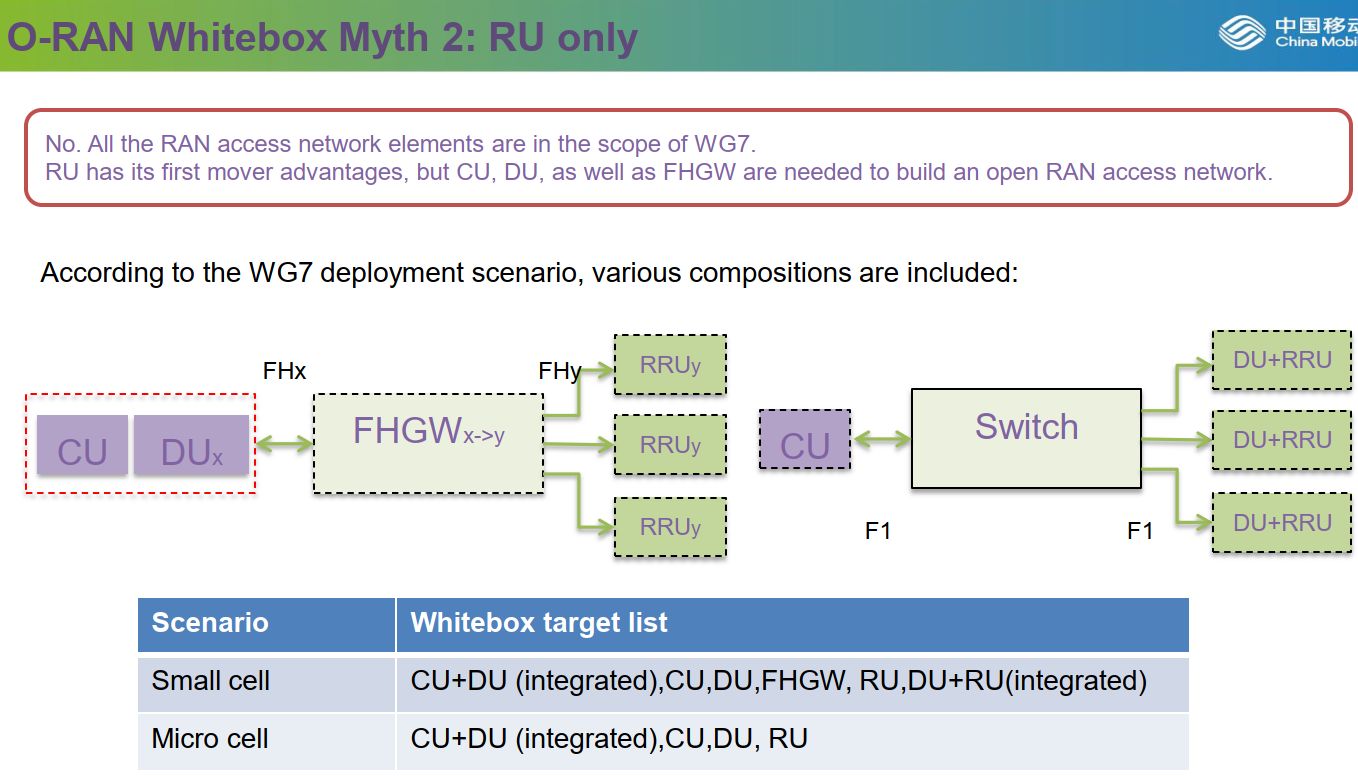

China Mobile’s Chih-Lin I looked at Open RAN. “5G is causing the convergence of IT information technology) and CT (communications technology). Open RAN brings about a smart ecosystem.” She defined open RAN as having open interfaces, open software, and open hardware, a so-called “white box.” That’s different from other definitions where only the interfaces are open. Figure 9 shows how network equipment manufacturers and network operators are working together on open RAN architecture. Other working groups are developing the details of open RAN white boxes and reference designs.

She then went on the describe several myths surrounding open RAN.

- Indoor only. Working Group 7 (WG7) defines indoor and outdoor applications.

- Radio Unit (RU) only. The Open RAN Coalition’s WG7 specifications include those for distribution units (DUs) and centralized units (RUs). Figure 8 includes all parts of the open RAN.

- Enhances Common Public Radio Interface (eCPRI) only. Open RAN includes other interfaces, not just the one between the RU and DU.

- Hardware only. Open RAN is mostly software, making for configurable RANs that can change as requirements change.

- Run on servers only. Open RAN software can run on standard PCs.

- Runs on x86 processors only. Open RAN software can run on ARM processors and FPGAs, or a combination.

Figure 9. Open RANS need interfaces between the remote radio unit (RRU), distribution unit (DU), and centralized unit (CU). Source: IMS2020/IEEE.

5G still has a long way to go and as the IMS 5G Summit speakers told us, there are plenty of problems for engineers to solve. Heat and inefficiency in power amplifiers is high among them. Open RAN has yet to prove itself and even if the technology works, it could take years to replace proprietary radio baseband units.

Tell Us What You Think!