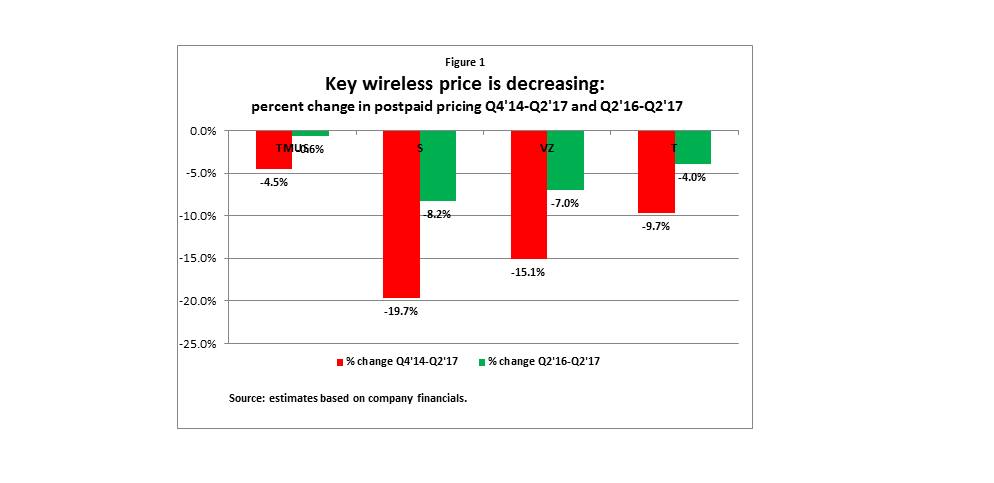

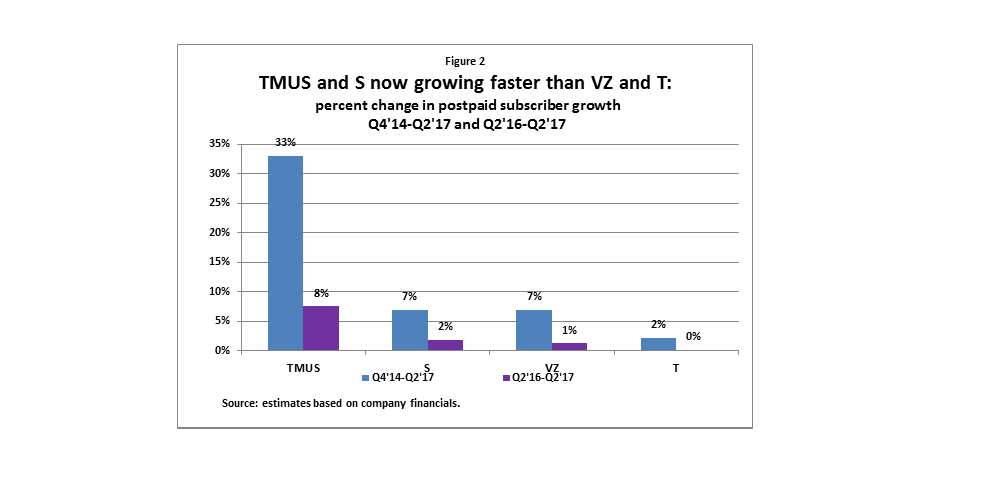

That the wireless industry is very competitive should be obvious to anyone who looks at recent statistics. All four of the national carriers have now reported their 2Q’17 results. As figure 1 shows, the wireless industry is highly price competitive. As figure 2 shows, it is also clear that T-Mobile, in particular, is gaining subscribers in the key postpaid category much faster than AT&T or Verizon.

The vast majority of subscribers pay their bill monthly after they use their wireless service, i.e. they are postpaid subscribers. Thus, the key metric watched by analysts is the trend in postpaid average service revenue divided by postpaid units or accounts (ARPU or ARPA). In the last year, postpaid prices have fallen at each of the national wireless carriers, at rates of 8.2 percent at Sprint, 7.0 percent at Verizon, 4.0 percent at AT&T, and 0.6 percent at T-Mobile. Since the end of 2014, they have fallen 19.7 percent at Sprint, 15.1 percent at Verizon, 9.7 percent at AT&T, and 4.5 percent at T-Mobile.

Figure 1. Credit: Anna-Maria Kovacs

Subscriber trends also show the intensity of competition. As background, it is worth noting that at the end of 2006 (when Sprint finished its acquisition of Nextel and AT&T its acquisition of Bellsouth), AT&T, Verizon, and Sprint had relatively similar numbers of postpaid subscribers while T-Mobile was roughly half the size of Sprint—at 52 million, 55 million, 42 million, and 21 million, respectively. Today, Sprint has shrunk to 32 million postpaid subscribers but T-Mobile has grown to 36 million. In other words, T-Mobile was not held back from taking market share by lack of scale or other entry barriers, while Sprint lost share despite its far greater scale.

More recently, Sprint has begun to grow again, even as T-Mobile has continued to dominate the subscriber growth trends. Figure 2 shows that since the end of 2014, and especially in the last year, Sprint has also grown its subscriber base. By far the fastest growing wireless carrier since year-end 2014 has been T-Mobile at 33 percent, which grew roughly five times as fast as Verizon at 7 percent and sixteen times as fast as AT&T at 2 percent. Sprint’s growth rate also improved to 7 percent, matching that of Verizon, though not that of T-Mobile. In the last twelve months, T-Mobile at 8 percent has again far exceeded the growth of its competitors, with Sprint growing 2 percent, Verizon 1 percent, and AT&T flat.

Figure 2. Credit: Anna-Maria Kovacs

The growth at T-Mobile is perhaps even more remarkable given that its postpaid price cuts, as measured by postpaid ARPU, have been fairly restrained while those of its competitors have been far greater.

Given the pricing trends in this industry, it is not surprising that analysts who follow the industry are concerned about the extreme level of competition. For consumers, however, this is an industry that brings tremendous benefits.