Worldwide shipments of business smartphones were flat year over year while shipments of business tablets fell nearly 10 percent during the first quarter 2016, a new Strategy Analytics report said.

According to the report, shipments of business smartphones increased by just 0.5 percent over the previous year but dropped 21 percent sequentially to just 92.2 million units.

Business tablet shipments fared even worse, dropping 9.8 percent year over year and 34.5 percent from the previous quarter to 17.3 million units, the report said.

“Many enterprises withheld from investing in new deployments of smartphones in Q1 2016 and inventory built-up due to large volume purchases in Q4 2015,” Strategy Analytics senior analyst Gina Luk said. “New device launches from vendors popular with enterprises, such as Apple and Microsoft, were on the horizon, meaning enterprises held off large volume purchases until official launch dates were announced”.

Strategy Analytics said decreases in shipments were seen across the worldwide business tablet space. The firm said the global business tablet market is currently trending downward and has already reached its lowest point since the fourth quarter of 2013.

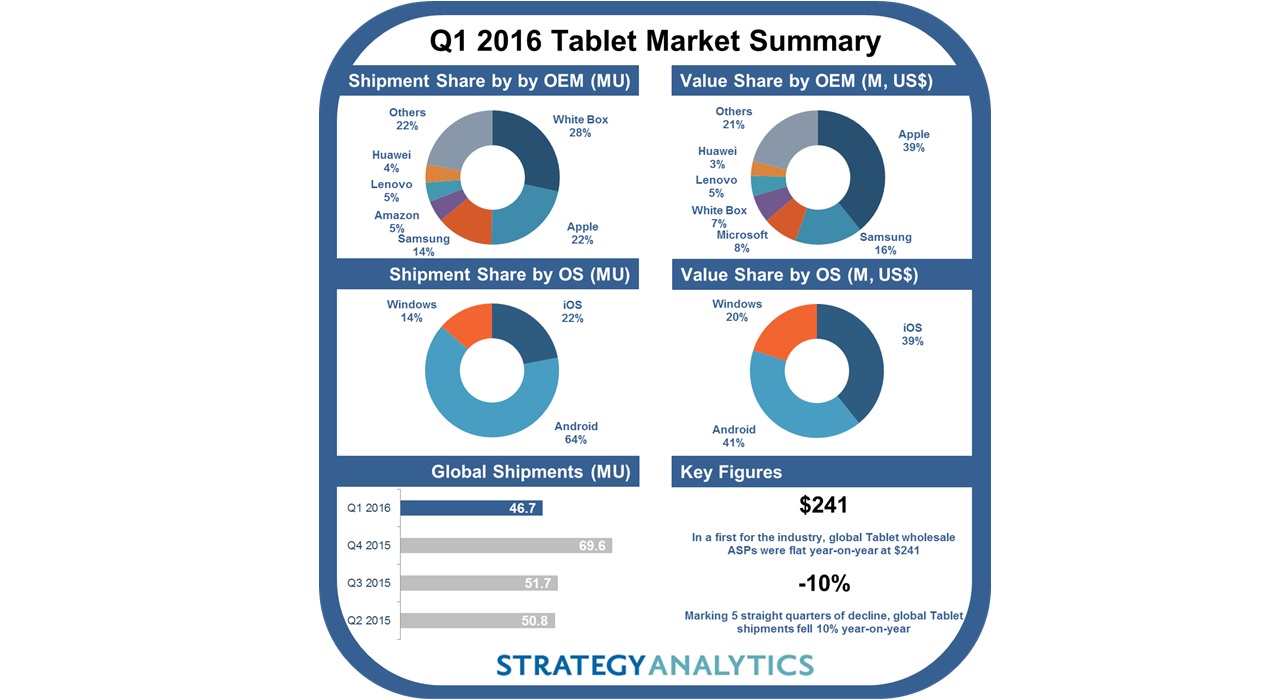

Click for detail. Credit: Strategy Analytics

Tablets Overall

And the general tablet market didn’t have much luck either, according to another Strategy Analytics report.

Global tablet shipments also fell 10 percent year over year to 46.7 million units, down from 51.9 million units in the first quarter 2015. The figure was also down 33 percent sequentially from 69.6 million units in the fourth quarter 2015. Tablet average selling prices of $241 were flat year over year.

“As a device, the tablet is going through a period of recalibration as productivity becomes more important, enterprises purchase more touchscreen and mobile first devices for a new generation of workers, and consumers begin paring down ownership of multiple computing devices,” Strategy Analytics senior analyst for Tablet and Touchscreen Strategies Eric Smith said. “We expect shipments to continue their slow decline over the next couple of years during which the usefulness, quality, and ASPs of tablets grow.”

During the quarter, Strategy Analytics said Microsoft and Apple combined to sell more than a million of their Pro Slate tablets.

With 13.1 million tablets shipped and 28 percent of the OEM market share, White Box continued to dominate, followed by Apple with 22 percent of the market share and Samsung with 14 percent of the OEM market share.

By operating system, Android topped the charts with 64 percent of the tablet shipment share, while Apple’s iOS and Microsoft’s Windows followed with 22 percent and 14 percent, respectively.

Despite a significant gap between Android, iOS and Windows in shipments, iOS nearly tied Android for value share, with 39 percent to Android’s 41 percent. Window brought up the back with 20 percent of the value share by operating system.