This year saw a record number of mobile users — over 4.92 billion recorded. But that number seems remarkably small when considered against the expected number of connected devices and endpoints that will be ushered in by the full maturity of the IoT era: Gartner predicts over 20.4 billion connected “things” in use by 2020. With 5G and the explosion of the IoT on the horizon, the network framework that has served the industry for so long is showing its cracks — leaving operators rightly concerned about how they’ll manage demand and make a profit when this stream turns into a deluge.

Why is this fundamental framework so dangerous for mobile operators? There is an unwinnable dichotomy in the market: demand is growing while revenues are declining.

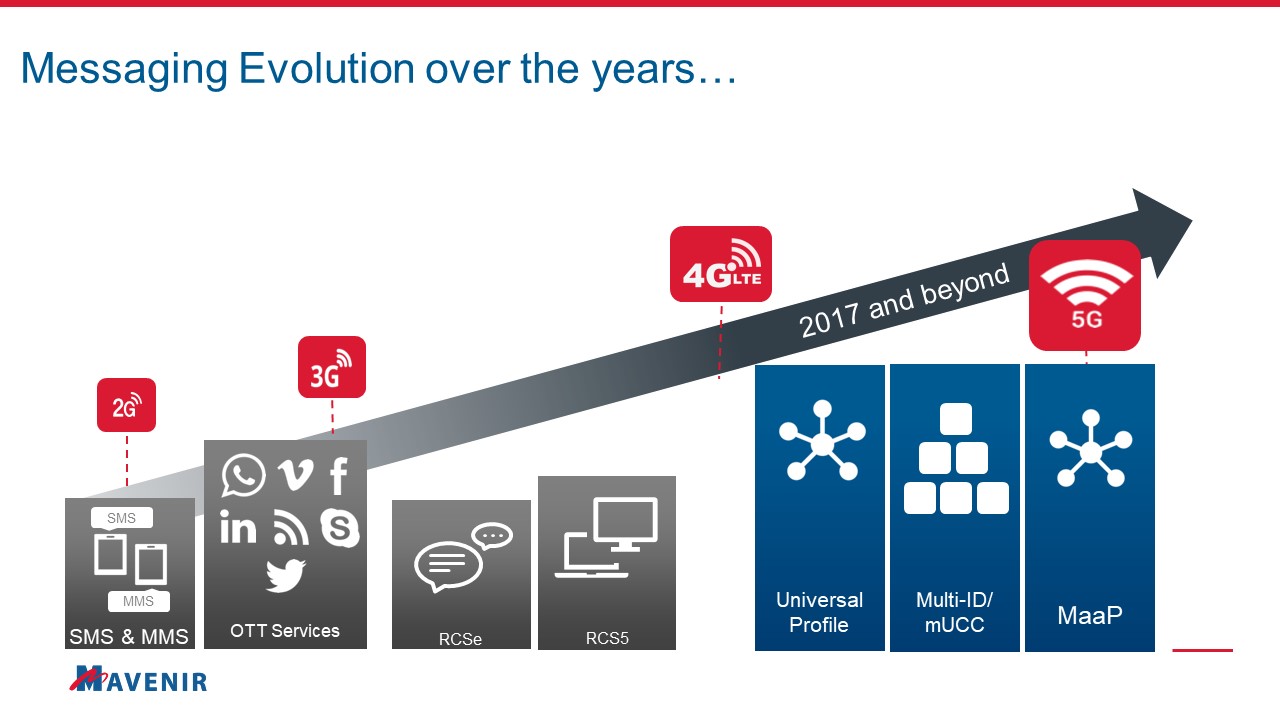

Operators are facing erosion of both market share and average revenue per user (ARPU) as consumer behavior is changing at a rapid pace, causing networks to struggle to keep up. Growing competition from over-the-top (OTT) providers and cloud giants like WhatsApp, Facebook Messenger and Google is causing worldwide ARPU to continue to drop for most operators. These new players are bringing a wealth of new, personalized services at very attractive price points or no cost at all. Plus, they’re able to bring innovative services to market and adapt to changing customer behavior much faster than legacy operators, given that they’re extremely agile and cloud-based. Consequently, operators are challenged with the task of reducing the cost of the network (as subscriber’s decreasing willingness to pay for their services yet demanding more speed & mobile data) while, simultaneously, there is severe price undercutting amongst the CSPs themselves, which is leading to declining margins all around.

Mobile operators are concerned, and for good reason. As the era of the IoT explosion and 5G looms and operators are looking to balance the equation, now is the time for them to drastically rethink how they’ve operated in the past and how they can prepare for the future. The decisions and investment they make today will lay the foundations for their new economics, and begin to future proof the 4G network for 5G use. So how can mobile operators move away from the traditional telco economic model and leverage this changing environment to capitalize on their broad subscriber base? There are three things operators should focus on to succeed:

Cost Reduction

As things stand, mobile operators are struggling to operate. Operators need to find ways to wring more profit out of what they provide – and offer their services for cheaper to drastically improve their ARPU, as the old cost-per-bit models and network architectures that dictated 4G strategies won’t support most 5G use cases, such as low-latency requirements. This means forgoing the old, hardware-driven models of the past and moving towards a new cloud-based architecture that allows them to find cheaper, more flexible and more efficient ways to operate, especially with 5G on the horizon. Nimble and flexible technologies like network slicing, Multi-Access Edge Computing (MEC) and Cloud RAN will be critical for operators to deliver better, faster and cheaper services. In fact, a recent study showed that, with Cloud RAN deployment, mobile operators can realize a 49 percent savings in capex and 31 percent annual savings in opex.

Revenue Generation

The mobile operators’ provided services — voice and messaging — that used to provide revenue have lost value to where today, 90 percent of services being consumed on mobile devices (commerce, content, social media) are not controlled by mobile operators (GSMA). The answer is to continue to innovate around those core elements and deliver new value-added services to subscribers, such as Mavenir’s Multi-ID cloud communications platform.

Operators can also look to take a page from T-Mobile’s playbook, as the company has demonstrated a lot of creativity in sourcing new revenue-generating services. Its new offering DIGITS — which decouples phone numbers from devices so a user can access that number on any compatible internet-connected smartwatch, tablet, or computer — is network agnostic, so a T-Mobile customer could add their ATT-provided work number to this plan, essentially allowing T-Mobile to make money on another operator’s offering.

Revenue Protection

Even if operators are able to successfully reduce costs and generate new recurring revenue streams, it’s all for nothing if they ultimately lose all this revenue to fraudsters. Mobile Squared predicts that annual losses in this industry are set to reach $11.4B by 2020. Operators need to invest in security solutions so they can protect their growing SMS-based B2C market, which is now under continuous security threat as cybercriminals try to get around B2C messaging rates. To protect the mobile operator’s revenue, security solutions utilizing Artificial Intelligence (AI) and machine learning, for enhanced messaging firewalls and A2P managed services are required.

These are all heavy lifts for mobile operators — but steps that are absolutely necessary to adapt to a 5G-enabled and IoT-driven world. However, even if operators address all of these different components, they are still only one piece of the network ecosystem: if their own partners and providers aren’t moving forward with them, this all comes to naught. 5G is a massive transition that all should be preparing for and investing in now — and working with a network provider who won’t be nimble enough or have the right technology is going to hold everyone back.

Pardeep Kohli is the president and CEO of Mavenir.