Credit: IDC

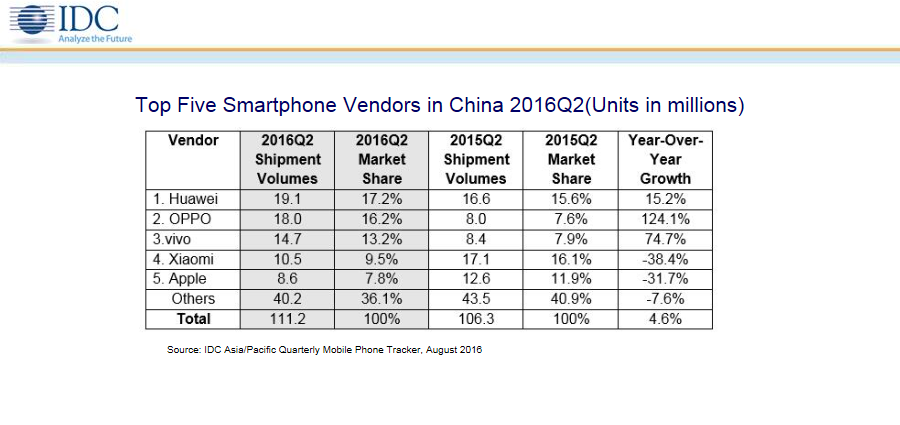

Chinese smartphone vendor Xiaomi lost its edge on the competition, sliding from first place a year ago to fourth in shipment volumes and market share in China in the second quarter, a new report from International Data Corporation (IDC) said.

According to IDC figures, Xiaomi slipped 38.4 percent year over year to drop into fourth place behind competitors Huawei, OPPO and vivo. The company’s shipment volumes reached just 10.5 million during the second quarter, down drastically from the 17.1 million shipments that held it in first place in the second quarter 2015. Xiaomi’s market share saw a corresponding decrease, dipping from 16.1 percent last year to 9.5 percent in the second quarter.

Bloomberg reported Xiaomi took issue with the IDC numbers and pointed to other data from IHS and Strategy Analytics, which placed Xiaomi’s second quarter shipments at 14.2 million and 12.8 million, respectively. But even with the higher shipment figures, Strategy Analytics – like IDC – had Xiaomi falling to fourth place behind Huawei, OPPO and vivo.

Strategy Analytics attributed the drop to touch competition in the mid-tier segments from the likes of Huawei, Gionee, LeEco and others. IDC said Xiaomi also lost out because the competition took up Xiaomi’s strategy of selling its devices online and also stepped up their marketing tactics with celebrity endorsements to draw customers.

While that may work in the short term, IDC said differentiation is how vendors will be able to win customers in the long term.

“The success of Huawei, OPPO, and vivo in the market can be attributed to their concerted effort to build their brand and aggressive marketing to attract the consumers, along with the focus on product differentiation,” IDC Asia/Pacific Senior Market Analyst for Client Devices Research Xiaohan Tay said.

IDC said Huawei and OPPO, which achieved 15.2 percent and 124.1 percent growth year over year, drew new users with their marketing focuses on key technologies. For Huawei, advertising honed in on its P9 camera feature, which proved popular through WeChat. OPPO also focused on camera and selfie capabilities in its R9 smartphone, but also touted the device’s fast charging capabilities, IDC said.

Huawei and OPPO exited the second quarter with 19.1 million and 18 million shipments, respectively, according to IDC figures. Vivo was in third place with 14.7 million shipments, IDC said.

During the quarter, Apple stumbled as Chinese consumers largely ignored the iPhone SE in favor of devices with larger screens. The company’s China shipments totaled just 8.6 million in the second quarter, down nearly 32 percent from 12.6 million the year prior, IDC said.