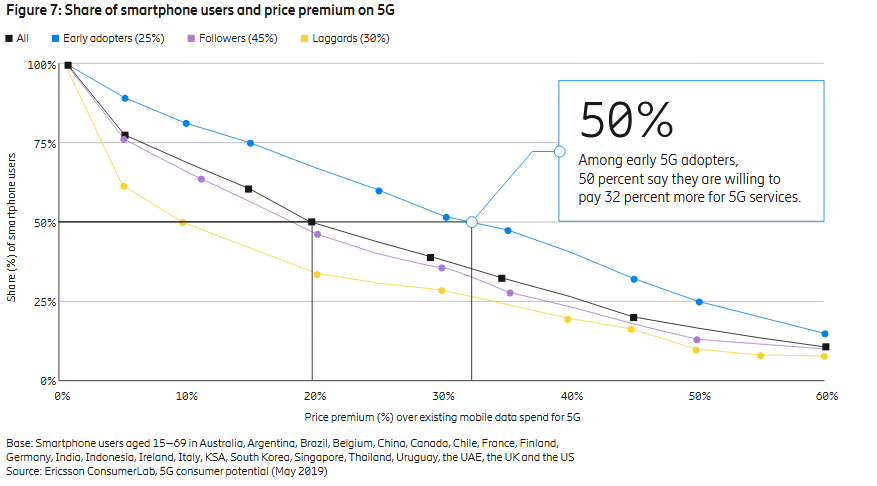

(Image Source: Ericsson’s 5G Consumer Potential report)

As the mobile industry works to make the case for 5G, a new report from Ericsson finds that contrary to popular perception, consumers have high expectations for the next-gen technology and many are willing to pay a premium for it.

In regards to 5G, a good deal of attention has been paid to industrial and enterprise applications. In its ConsumerLab report Ericsson aims to dispel what the telecom equipment vendor identifies as key myths around 5G, including a lack of any real consumer use cases for or price premium on 5G.

The report is based on responses from 35,000 smartphone users aged 15-69, spanning 22 countries, as well as 22 expert interviews for industry perspective. About 4,500 respondents were from the U.S., representing opinions from about 160 million smartphone users, explained Jasmeet Sethi, head of ConsumerLab at Ericsson in an interview.

New Services Key to Consumer Willingness to Pay

When it comes to pricing, most smartphone users indicated that for 5G benefits, they would be willing to pay 20 percent more than they do today. That premium increases among early adopters, half of whom would pay up to 32 percent above what they pay now. Still, those willing to shell out more money also expect more than just increased speeds: 43 percent of smartphone users willing to pay a 40 percent premium for 5G cited new applications and services as a key component of a 5G plan.

“If you just start selling speeds, it’s very difficult to monetize 5G from a consumer perspective,” Sethi said. “What consumers are really looking for is if you start bundling services on top of connectivity.”

Sethi said consumers are also looking for new payment models for 5G, such as paying per session, or by number of hours, for examples services like cloud gaming.

As 5G deployments are still in the early days, price points and structures for 5G mobile subscriptions have yet to be clearly defined. In the U.S., Verizon just recently pulled back on a $10 premium charge for its 5G service plans, while T-Mobile executives have indicated the operator won’t change rates from current levels for 5G data plans and will continue to offer unlimited plans for 5G.

The Ericsson report suggests that 5G wireless home broadband is one of the early applications consumers both expect and are willing to pay for.

Globally, one-third of fixed home broadband users are interested in switching providers in the next six months, according to Ericsson. Of those respondents already looking to switch broadband providers, 8 in 10 said they would consider either replacing or supplementing their existing broadband with 5G home wireless broadband. 5G home broadband, when bundled with an UHD 5G TV service was named as a top use case, with 74 percent of survey respondents expressing high interest and willingness to pay for that service.

Verizon last year was the first to launch 5G home broadband services, though MoffettNathanson analysts have been skeptical about the ability to economically deploy the 5G service at scale. T-Mobile has been working to shake up the pay TV space since acquiring MVPD Layer3 TV, and the operator said it will be able to bundle TV with fixed wireless home broadband services, pending regulatory approval of its proposed merger with Sprint.

AT&T and Verizon’s initial mobile 5G rollouts are using high-band millimeter wave spectrum, while T-Mobile’s 5G rollout will lean on 600 MHz spectrum, and Sprint plans to utilize its large 2.5 GHz spectrum holdings.

Sethi indicated that from a consumer perspective, users don’t necessarily care whether applications are using millimeter wave or sub-6 GHz spectrum. Rather it’s a matter of the provider looking at the specific use cases that customers demand and then matching needs (be it high-capacity or broad coverage) of those services with the correct spectrum assets.

“Consumers are not looking for peak speeds,” Sethi said, noting that for 5G what consumers really want is a consistent experience.

A second area of high consumer interest named in the report are 5G hot zones that delivers ultra-high speeds and reliability in congested locations like airports, shopping areas and offices.

Still, Sethi noted that consumers are being vocal about concerns over experiencing extreme performance drop off when they leave a concentrated 5G coverage zone meant to meet high-capacity needs, and enter an area where 5G coverage doesn’t extend.

The transition “needs to be much more seamless,” Sethi said. “What that means is the underlying 4G network also needs to be quick in order to provide a good foundation for 5G.”

Consumer 5G Timeline Expectations

From Ericsson’s report, it appears consumers expect that relevant 5G applications and services are just around the corner. Consumers in the U.S. in particular predict most early 5G apps and services will become mainstream within one year of 5G’s launch.

In the first few years they expect current pain points to be addressed with enhanced capacity, reduced network congestion, 5G TV and 5G fixed wireless access availability. The next two to three years consumers think VR/ AR services will be widespread, at which time Sethi said they expect to see new device form factors coming in. The five- to six-year timeline is when consumers expect 5G automotive applications to enter the mainstream.

Consumer expectations largely line up with views of those in the industry, according to Sethi.

“If you look at the roadmap for these use-cases and you match what the experts are saying, I think consumers are very pragmatic about what they’re demanding from 5G.”

Interestingly, many consumers don’t see smartphones as the main device that will enable 5G capabilities.

“Globally, 50 percent of consumers believe that smartphones will still exist but that perhaps we will all be wearing AR glasses by 2025,” Ericsson wrote in the report. Notably, one-third disagree that AR glasses will be mainstream in the next 5 years.

To read Ericsson’s full report, including other 5G consumer myths, check here.