Recent headlines about sequestration and the Budget Control Act of 2011 have amplified ongoing concerns about decreased spending on U.S. aerospace and defense programs.

Recent headlines about sequestration and the Budget Control Act of 2011 (BCA2011) have amplified ongoing concerns about decreased spending on U.S. aerospace and defense programs. This downturn is of great interest to companies that provide test and measurement (T&M) hardware, software, and services to the aero/defense industry.

Recent headlines about sequestration and the Budget Control Act of 2011 (BCA2011) have amplified ongoing concerns about decreased spending on U.S. aerospace and defense programs. This downturn is of great interest to companies that provide test and measurement (T&M) hardware, software, and services to the aero/defense industry.

Data from the U.S. Department of Defense (DoD) shows that spending has been falling since 2011. However, it can also be shown that the decline may have occurred without BCA2011 and sequestration — although it is likely that these accelerated the decline.

In spite of the seemingly bleak outlook, DoD spending plans and recent congressional action make one thing clear: during fiscal 2013, investments in more than 200 programs have continued unabated. However, it is important to note that available information suggests there may be fewer new program starts and potentially more cuts to modernization programs in fiscal 2014. Even though upgrades typically require a significant amount of T&M equipment, the focus is likely to shift towards purchase strategies that help lower the total cost of test. This shift could have important implications for prime contractors and the T&M industry.

Past, Present, and Near Future

Since 1948, the industry has seen this type of budgetary reset in the aftermath of every major military conflict. For example, after peaking during the Korean War, the Vietnam War, and the last stages of the Cold War, U.S. defense spending dropped by an average of 36 percent over the seven years following the end of hostilities. Now, in the post-9/11 period, spending has dropped farther and faster.

Looking at data from the Congressional Budget Office, the Future Year Defense Plan (FYDP) shows three potential trends: fewer new platforms, decreased spending on acquisitions, and increased spending on operations and maintenance (O&M). In pursuit of lower acquisition costs, the DoD is moving toward fixed-cost or firm-fixed-price (FFP) contracts. Compared to cost-plus, FFP places a greater burden on prime contractors (Table 1).

Implications and Solutions

These trends may have important implications for T&M manufacturers. As an overall observation, less emphasis on new platforms means greater spending on O&M of existing platforms, including periodic upgrades. Modernization of platform technology tends to be test-equipment intensive.

These trends may have important implications for T&M manufacturers. As an overall observation, less emphasis on new platforms means greater spending on O&M of existing platforms, including periodic upgrades. Modernization of platform technology tends to be test-equipment intensive.

Focusing on technology, three things are likely to stay the same whether aero/defense customers are testing new or upgraded systems: they will need faster measurements, better measurement performance, and greater cost-effectiveness.

From a business perspective, T&M solutions must satisfy customers’ increasing focus on reducing the total cost of test. By achieving this goal, all participants will benefit from a reassessment of old assumptions and a fresh look at new ways of doing things.

More Measurements in Less Time

Antenna technology continues to become more sophisticated, especially in advanced radar systems. New active-array antennas require a dense population of transmit/receive (T/R) modules. Because these systems also support multiple functions, measurements can become more complex and time-consuming.

Antenna technology continues to become more sophisticated, especially in advanced radar systems. New active-array antennas require a dense population of transmit/receive (T/R) modules. Because these systems also support multiple functions, measurements can become more complex and time-consuming.

Testing such systems in a timely manner requires not just higher resolution and wider bandwidth but also new methodologies. In response, Agilent has developed a digitizer that provides a wideband, multi-channel, phase-coherent platform for cross-channel measurements of magnitude and phase. The core of the system is an eight-channel, 12-bit, high-speed digitizer in an AXIe form factor. It can capture signals from DC to 800 MHz at 1.6 GSa/s (Figure 1).

To perform more measurements in less time, a system can be scaled up to a total of 40 synchronous channels in 4U of rack space. This wideband configuration can enable speed improvements relative to conventional approaches often used for cross-channel measurements.

More and Better Performance

In military and commercial settings, the spectral environment is becoming increasingly complex. A quick look at any naval vessel illustrates the point: it may carry surface-search radars, microwave links, satellite links, and radio antennas. An engineer may need to check for interference between these transmitters or with shore-based transmitters.

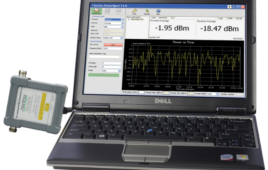

In many cases, this type of analysis requires more than a conventional spectrum analyzer. One solution is a real-time spectrum analyzer (RTSA). In the past, this functionality was only available in expensive, single-purpose instruments. Today, RTSA is an optional capability that can be added to new or existing signal analyzers, such as the Agilent PXA and MXA (Figure 2).

The ability to see, capture, and understand highly elusive signals is enhanced by high-frequency range, wide analysis bandwidth, high-dynamic range, and low noise floor. Detection is further enhanced with a capability called frequency-mask triggering (FMT), which can initiate measurements based on specific spectral content and behavior. RTSA and FMT can be combined with Agilent 89600 VSA software for comprehensive demodulation and vector signal analysis.

Leveraging COTS Equipment

The preceding examples point to a third scenario: testing the performance of radar systems with multi-emitter spectral environments. In some cases, this type of testing may be performed using large, expensive systems.

Prior to such testing, however, it can be useful to assess radar-system performance on a more limited scale during the R&D phase. Cost-effective systems based on commercial off-the-shelf (COTS) equipment make this possible.

One such solution from Agilent combines design simulation software and a high-speed, high-resolution arbitrary waveform generator (AWG). Agilent SystemVue electronic system-level (ESL) software can be used to create a variety of emitters: radar, wireless communications, wireless connectivity, and more. The resulting signal scenarios can be downloaded to and played back by an AWG such as the 12 GSa/s Agilent M8190A.

Although this approach is memory-based and doesn’t offer real-time capabilities, it does enable flexible and cost-effective multi-emitter testing in an R&D setting. As a side benefit, the COTS equipment can be easily repurposed for other activities when the test system is not in use.

Mark Twain’s wisdom aside, history may repeat itself when it comes to defense spending. Until the next major upswing, primes, government entities, and T&M vendors may be looking for new ways to get the job done with greater operational efficiency and a lower total cost of test.