I attended MWC 2018 in Barcelona, Spain this year. In addition to tapas, snow and sleep deprivation, I enjoyed numerous meetings, dinners, parties and receptions. Here are some of my thoughts around the key themes of the show:

Ubiquitous 5G

5G was clearly the dominant topic of the show, with vendors, operators and solutions providers all touting their leadership positions and strategies. With the approval of the initial 5G standard in December 2017, some of the leading operators have announced their initial trials and deployment plans. Initial 5G new radio (NR) deployments are destined to operators in China, Japan, South Korea and the United States. Both standalone (with a new 5G core network) and non-standalone (with functionality added to the evolved packet core) deployments were discussed.

With the exception of China, most operators intend to deploy 5G NR in a NSA core network. The SA standards are due to be completed in 2Q18 with first products being available for trials in 2019.

Who needs 5G?

Infrastructure vendors need 5G. Since the 4G network build-out has been completed, infrastructure vendors have struggled to find growth, and have contracted and merged as a result. New growth is likely to come from 5G-based radio access networks, transport and core. As a result, the networks are aggressively developing products and positioning themselves for growth.

Network operators need new incremental revenues to justify the continued investment in their networks and spectrum. Network operators are aggressively touting 5G to motivate the ecosystem (i.e. infrastructure, applications and smartphone vendors) to develop products rapidly and to motivate regulatory authorities to allocate additional spectrum to 5G services. This is due to the need to create new revenues, to develop new business models and to compete with both other operators and webscale service providers.

In particular, the United States needs to find a way to allocate additional spectrum in the “mid-band,” or around 3.5 GHz. Unfortunately, this spectrum is currently being used by naval radar systems so it is not easily reallocated.

Given the complexity associated with developing, deploying and testing a new core network — including new signaling, new network elements for network slicing and the possibility of a distributed user-plane function — we believe it will be several years before everything stated above can become a reality.

WiFi economics

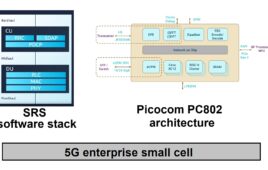

In the ocean of announcements during the show, one stood out that has the potential to reshape the mobile infrastructure market — the formation of the ORAN (Open Radio Access Network) Alliance.

AT&T, China Mobile, Deutsche Telekom, NTT DOCOMO and Orange jointly announced the creation of the ORAN Alliance. … ORAN will combine and extend the efforts of the C-RAN Alliance and the xRAN Forum into a single operator led effort. … Key principles of the alliance include:

– Leading the industry towards open, interoperable interfaces, RAN virtualization and big data enabled RAN intelligence.

– Maximizing the use of common-off-the-shelf hardware and merchant silicon and minimizing proprietary hardware.

– Specifying APIs and interfaces, driving standards to adopt them as appropriate and exploring open source where appropriate.

The RAN is, by far, the largest component of a mobile operators’ network in terms of investment. This agreement sets the stage for increasing openness and competition, allowing for more competition between the current RAN vendors and allowing for possible entrants. This is salient because cell densification will become even more important with 5G, and with the increasing use of higher frequencies. Therefore, openness, competition and economies of scale will be needed to drive the costs necessary for such deployments.

Greg Collins is the founder and principal analyst of Exact Ventures.