(Image Source: Qualcomm)

Commercial 5G networks and smartphones have already launched in the U.S. and around the world, but as we wait for consumer applications to surface, much industry attention is also focused on the potential of 5G for private networks and Industrial IoT.

“For industrial IoT, the increase in capacity and improvement in latency are just as, if not more, important [than speed],” Kevin Hasley, executive director of performance benchmarking for RootMetrics by IHS Markit told Wireless Week. “Lower latency will help propel the growth of smarter factories that have the ability to process more information, react quicker, and create products at a potentially cheaper cost.”

Qualcomm has taken a particular interest in industrial applications using a portion of the 6 GHz band, which the FCC last year proposed opening up 1,200 megahertz of for unlicensed use, and the chip giant has been developing techniques that utilize synchronization to share spectrum more efficiently among users in the same location.

Dean Brenner SVP of Spectrum Strategy & Technology Policy at Qualcomm Brenner wrote a blog on the topic last month, and Qualcomm demoed the technology at this year’s MWC in Barcelona.

It’s not only the U.S., other parts of the world are also looking at the 6 GHz band, including Europe and China, considering licensed, unlicensed, or a mix of both.

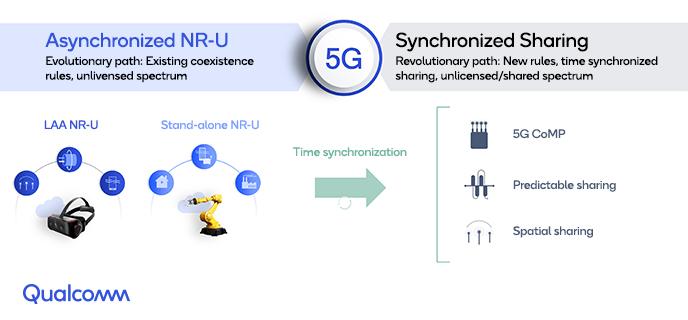

In December, 3GPP approved a work item for Release 16 to define 5G for unlicensed spectrum, called 5G NR-U. In addition to support for operations in the existing unlicensed 5 GHz band, with a 5G version similar to License Assisted Access (LAA) for LTE, there will also be a standalone option using only unlicensed or shared spectrum, including the 6 GHz band.

Work on 3GPP Release 16 is expected to be finalized some time in 2020.

New 6 GHz spectrum, when combined with new technology, can solve connectivity issues in places like warehouses, factories and ports that require faster and more reliable and robust connections than current WiFi technology can provide, or mobility not offered by wired connections, Brenner told Wireless Week in an interview.

Qualcomm filed comments with the FCC in February, detailing its vision for the 6 GHz band and urging adoption of technology-neutral rules giving precedence to synchronized systems to enable 5G NR-U and next-gen WiFI 802.11be technologies.

Time-synchronized Spectrum Sharing

The technology Qualcomm is working involves a new way of sharing spectrum that is based on beam direction rather than splitting time between users. This technique is called time-synchronized sharing and enables users in the same geographic area to utilize spectrum simultaneously, driving what Brenner described as “gigantic” efficiency gains of three or four times more throughput.

This is in contrast to how unlicensed spectrum is shared today, an asynchronous sharing method where nodes (even those on the same network) must listen first to see if a channel is in use. While the node “listens” it remains silent and is unable to use the spectrum until its turn so as not to interfere, as must other nodes sharing the channel. This method can fall short as networks become more burdened, like in industrial settings that potentially require thousands of sensors or modules.

Enter 5G, which brings fast new radios and many base station and device antennas capable of transmitting very narrow beams that are steered and highly directional, Brenner explained.

With Qualcomm’s technique, operations are time-synchronized and users know which spatial direction others are going, so everyone in a system that’s employing a synchronized approach can utilize spectrum at the same time without blocking each other.

In terms of IIoT, Brenner envisions high-performance use cases, in a factory for example, with robots and machinery that require mobility and lower, more predictable latency.

For unlicensed spectrum, time-synchronized operation would enable ultra-reliable low latency communication using Coordinated Multi-Point (CoMP), more consistent quality-of-service when sharing spectrum compared to current WiFi and LAA, and increased spectral efficiency, according to Qualcomm.

Still, there will be users who aren’t synchronized and continue asynchronous operation. In a port setting for example, or a piece of equipment in a factory that’s not part of the synchronized network, Brenner explained.

To incentivize time-synchronized sharing where possible, Qualcomm proposed partitioning a 350 megahertz portion of the 6 GHz band that would give time-synchronized nodes precedent. While still refining the rules, Brenner clarified it wouldn’t necessarily be prioritization for synchronized users, as asynchronous operations could still use the band but would first check if any synchronized nodes were already operating.

Yongbin Wei, senior director of Engineering with Wireless R&D at Qualcomm said the company envisions the small portion that gives precedence to time-synchronized systems would only be used in locations where operations really require it, in settings where certain applications can’t be handled in the traditional way.

Wei, who with colleagues is developing the new technology, said the 6 GHz band also presents a great opportunity for the WiFi ecosystem, in terms of how next-generation WiFi will take advantage of this “critical” part of the band.

Global Interest

With interest in 6 GHz spanning the globe, and varying frameworks of use being considered in different countries, Brenner explained the synchronized techniques can be employed regardless of whether 6 GHz spectrum is licensed, unlicensed, or a mix of both.

“Every major region in the world is focusing on this industrial IoT, private network, vertical use case,” Brenner said. “The interest is incredible.”

A key consideration for Qualcomm when it comes to developing 6 GHz technology is maintaining a level of commonality or harmonization of at least part of the band, no matter what region machinery is produced or operations take place in, according to Wei.

Brenner said that Qualcomm has been working and speaking with players around the world, noting particular interest from major industrial companies like Bosch, Siemens, and GE, that want better connectivity in factories and warehouses in order to drive productivity and efficiency gains, and eventually, monetary payoff.

While Qualcomm is best known for its smartphone chip business, the company also creates chips for small cells or access points, which Brenner said is the part of the business that would tie in with the 6 GHz work, alongside tech for industrial machine modules.

Another company focusing efforts on 6 GHz is Federated Wireless, an industry player that helped spearhead efforts to commercialize the shared CBRS 3.5 GHz band.

In an earlier interview last month Federated CEO Iyad Tarazi told Wireless Week that the company is putting significant work into 6 GHz and in May had a prototype device built. Tarazi said at the time that Federated was starting to put a commercial team in place and had four or five commercial partners that are “fairly significant” in this space.

A recent May filing detailed a meeting between Federated and the FCC, in which Federated said a simplified version of spectrum sharing technology used in the CBRS 3.5 GHZ band would provide an “ideal solution” for the 6 GHz band, protecting incumbents while allowing new unlicensed users to maximize access to the band quickly and efficiently.

Federated indicated it would demo the fully functional automated frequency coordination (AFC) prototype “in the very near term.”