Engineers designing 5G base stations must contend with energy use, weight, size, and heat, which impact design decisions.

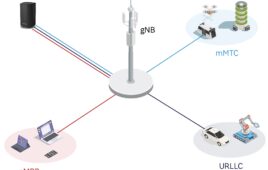

5G New Radio (NR) uses Multi-User massive-MIMO (MU-MIMO), Integrated Access and Backhaul (IAB), and beamforming with millimeter wave (mmWave) spectrum up to 71 GHz. These capabilities provide massive connectivity, multi-gigabit speeds, and single-digit-millisecond latencies that help distinguish 5G from 4G and older generation wireless technologies. Unfortunately, they present design challenges focused on power, heat, size, and weight.

5G NR brings fundamental changes to the gNodeB’s power amplifier (PA) and power-supply unit (PSU). These changes directly affect operators’ capital expenditures (capex), operational expenditures (opex), and their ability to provide the coverage and quality that customers demand.

In 2G, 3G and 4G, the PA and PSU were separate components, each with its own heat sink (Figure 1). For a variety of reasons, many infrastructure OEMs are considering integrating the PSU into the gNodeB, where it will share a heatsink with the remote radio unit (RU) PA in so-called active antenna units (AAU). This change creates a host of design considerations and challenges.

Reduce electricity use

Power consumption is one major reason for these changes. Electricity currently is 5% to 6% of a mobile operator’s opex, according to MTN Consulting [Ref. 1]. Energy use will increase dramatically with 5G because a typical gNodeB uses at least twice as much electricity as its 4G counterpart, MTN says.

Higher opex makes it difficult for operators to price their 5G services competitively and profitably. Some operators have tried to rein in their 5G electricity opex by using 8T8R and 32T32R MIMO systems rather than 64T64R — a compromise that can undermine performance. Even so, the additional PAs and additional signal processing needed in these MIMO AAUs drive up the power requirements, yet additional space and cooling aren’t provided.

These challenges might come as a surprise because 5G is promoted as being more energy efficient than 4G. This comparison, however, is based on the number of bits of data delivered for a given unit of energy consumed. Using mmWave will require multiple small cells, which will result in higher overall energy consumption even though it’s more efficient in transmitting data than previous generation wireless technologies. Equipment manufacturers have been looking at ways to reduce this energy consumption to help operators lower their carbon footprint.

For example, 4G radios are always on (e.g., transmitting reference signals to detect users), even when traffic levels don’t warrant it, such as in the middle of the night. 5G base stations can analyze traffic patterns and determine periods of low data-traffic, when it may be suitable to shut down into a “sleep mode.” An example being considered during this time is to power down the radio in the range of 5 msec to 100 msec, and then enable it to see if there are any active devices within range, ensuring that the network is always available for 911 calls and time-sensitive IoT transmissions.

Known as “pulse power,” this technique reduces opex by minimizing energy consumption as only the essentials of the cell site remain powered during the sleep mode. This technique will result in lower average energy consumption and result in lower operating costs for the operators.

Infrastructure OEMs focus on two aspects of pulse power. First, they want to understand how these power cycles affect the overall life of the PSU. The typical expected life of an RU is in the range of 7 to 10 years. A failure of an antenna results in network downtime, compromise in network reliability, and could result in revenue loss.

Second, they want to know how low power consumption can drop when the PSU is in quiescent mode. For example, when the PSU stops powering the PA, which is the main power draw, but still needs to power other electronics. The current target for low-load efficiency is about 30%. Some OEMs would like to see it closer to, for example, 10%.

Equipment providers must find the minimum power required to support radio functions during the quiescent period. PSU manufacturers must minimize power consumption during this quiescent period. The PSU must immediately power-up and provide the necessary power for the radio to resume normal operation and provide this power with minimum voltage transient effects. Plus, it must survive being repeatedly switched from quiescent and normal-power modes and still maintain reliability and life specifications.

During quiescent periods, the PSU must minimize all load power. It must keep basic antenna functions ready, then then go to full power when the antenna checks for active users within range, typically from 5 msec to 100 msec.

Don’t get too heavy

Siting is another major reason for the PA and PSU changes. For example, in dense urban areas, 5G networks will rely heavily on mmWave spectrum in massive MIMO antennas to deliver gigabit speeds. The higher the frequency, the shorter the signals travel, which means mmWave 5G will require a much higher density of small cells. Many of them also will need to be close to street level and thus close to people.

Small cells are being deployed on utility poles and streetlights, which have limited space for radios and cables (Figure 2). Meanwhile, similar constraints on macro sites operating at traditional sub-6 GHz frequencies play a role. For example, many towers are already jammed with cables, whose weight affects their wind load and thus antenna capacity.

An operator’s gNodeB product choice directly affects its ability to get the sites it needs to provide seamless coverage, which in turn affects its competitiveness. OEMs also want to limit the weight of the AAU (e.g., to less than 50 lbs/23 kg.) to ensure a single person can install it. This situation creates opportunities for engineers to design gNodeB products that minimize radio size, reduce weight, and reduce accessory weights such as those from power cables.

Multiple pairs of low-gauge cables are used to distribute -48 V power to the RUs on the tops of cell tower antenna masts; they’re also used to minimize voltage drops (Figure 3). These cables are expensive, heavy, and must be supported by the cell tower in addition to the multiple antennas and other equipment. Technicians must place 5G radios supporting mmWave higher than other antennas to minimize attenuation from obstacles. Using higher voltages to distribute the power to these antennas could reduce cable weight. Higher gauge cables could distribute 120 VAC or 240 VAC, or even 400 VDC, thereby lessening the load on the antenna masts and minimizing voltage drops. Higher gauge wires lower both purchase and installation costs.

As with pulse power, making this change requires understanding how the higher voltages would affect PSU designs and component life. Server OEMs perform similar research, much as the data center world considers a shift to higher voltages to lower their current consumption and opex. Mobile OEMs may be able to learn from their IT counterparts — albeit with a few caveats. For example, mobile operators typically want PSUs to be designed to last about 10 years, whereas a data center server usually is retired after about four years.

Personnel safety is another consideration. Cell site installers work with -48V DC, so they’ll need training to safely work with higher voltages. Operators’ drive for lower opex costs coupled with meeting their climate change goals may hasten this transition.

Size and heat

Another design under consideration looks to integrate the PSU within the RU, which reduces weight and shrinks the size of the RU (AAU). In this architecture, the PSU will share the heatsink with the PA. This combination creates several design challenges, starting with heat. PAs have much lower efficiency than PSUs. That heat dissipates into the shared heatsink, raising its temperature and resulting in less available cooling capability for the PSU. PSUs that traditionally operated at 85°C will now need to endure temperatures of 95°C to 100°C, an increase that could affect component life and performance.

Integration also increases the risk of signal interference, which results in poor network quality. That raises two issues with integrated PSUs:

- Being close to the PA means the PSU will must be immune to the E-fields that the PA generates. The PSU also generates E-fields. These fields must fall within limits and not interfere with PA and other RU electronics.

- Integration must not cause passive intermodulation (PIM) interference with the radio frequencies.

PIM can occur when two or more signals pass through junctions of dissimilar materials — such as loose cable connections, contaminated surfaces, poor performance duplexers, or aged antennas — and mix to produce sum and difference signals within the same band, causing interference. Engineers must make careful design and manufacturing considerations to ensure the PSU will not cause PIM interference during its useful life.

To reduce weight, OEMs want the physically small PSUs. Meeting this goal will require the use of new switching technologies, such as gallium nitride (GaN) and silicon carbide (SiC), widely used in solar system inverters and in electric vehicles. Power FETs designed with these technologies may allow for operation in higher baseplate temperatures and higher frequency operation, resulting in smaller designs.

PSUs often get sandwiched with other components inside an AAU. Thus, engineers need low-profile components, typically under 22 mm.

The challenges and opportunities surrounding embedded PSUs highlight how 5G NR compares to previous wireless technologies. OEMs that help their customers overcome these challenges will position themselves for success in the burgeoning 5G market.

Reference

1. Matt Walker, “Operators facing power cost crunch,” MTN Consulting, https://www.mtnconsulting.biz/product/operators-facing-power-cost-crunch/

Dib Nath is a senior director of technical marketing, telecom and networking with Advanced Energy. He has more than 20 years’ experience in product line management and strategic marketing, as well as applications engineering for power conversion products and power systems used in telecommunications and the data-networking market space. He has both technical and marketing background and holds two U.S. patents. Dib has a bachelor’s and master’s degree in electrical engineering, as well as an MBA.

Dib Nath is a senior director of technical marketing, telecom and networking with Advanced Energy. He has more than 20 years’ experience in product line management and strategic marketing, as well as applications engineering for power conversion products and power systems used in telecommunications and the data-networking market space. He has both technical and marketing background and holds two U.S. patents. Dib has a bachelor’s and master’s degree in electrical engineering, as well as an MBA.

Tell Us What You Think!