Several standouts for 2022 reached our editorial offices. We present them here.

As one year ends and another begins, so come the predictions. Over the past two years, we’ve seen how predicting the upcoming year is harder than ever. That doesn’t stop anyone from trying, though. How many of us throught we’ve still be dealing with a global pandemic two years out? Truth be told, I never thought we’d be out of COVID-19 by now and still believe we’ll be lucky if it’s mostly over by 2023.

As one year ends and another begins, so come the predictions. Over the past two years, we’ve seen how predicting the upcoming year is harder than ever. That doesn’t stop anyone from trying, though. How many of us throught we’ve still be dealing with a global pandemic two years out? Truth be told, I never thought we’d be out of COVID-19 by now and still believe we’ll be lucky if it’s mostly over by 2023.

Several predictions for the telecom and communications industries have reached EE World’s editorial offices. From those, several trends repeated themselves across the prediction lists.

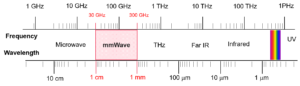

mmWave

From what we’re seen, mmWave’s short range is propelling the telco emphasis on obtaining as much mid-band spectrum as possible for mobile use. Some say that mmWave deployment for mobile use will simply be too expensive to overcome the short range. Indeed, the soothsayers are already writing off mmWave for mobile devices. (The one 5G-capable phone in my household has 5G turned off to improve battery life, which ranks above download speeds.)

From what we’re seen, mmWave’s short range is propelling the telco emphasis on obtaining as much mid-band spectrum as possible for mobile use. Some say that mmWave deployment for mobile use will simply be too expensive to overcome the short range. Indeed, the soothsayers are already writing off mmWave for mobile devices. (The one 5G-capable phone in my household has 5G turned off to improve battery life, which ranks above download speeds.)

Instead of mobile devices, mmWave applications look to focus on private networks or fixed-wireless internet access (FWA). More on private networks later, doubts included.

According to ABI Research’s 70 Technology Trends That Will—And Will Not—Shape 2022, mmWave deployment won’t accelerate.

“U.S. mobile operators are now focusing on C-band deployments following the recent spectrum auction, realigning their previous strategy to deploy mmWave first. U.S. operators have relied on existing (low-band) and mmWave spectrum to deploy initial 5G services, but both have faced challenges. Now that mid-band spectrum is available in the United States, all operators will likely shift to it, to take advantage of global economies of scale and technical maturity of C-band mMIMO units. Europe and China are deploying mmWave 5G for specific, niche use cases, meaning that mmWave will not be mainstream technology in 2022. mmWave 5G will likely accelerate once C-band 5G networks are congested, which is not expected in 2022 or even in 2023 in many regions.”

In a different prediction, ABI Research further casts doubt on mmWave in 2022, saying “5G mmWave Smartphone Shipments Will Not (Yet) Reach Critical Mass in 2022.” Nevertheless, the research firm still sees a place for mmWave.

“The industry’s move toward the use of 5G New Radio (NR) Millimeter Wave (mmWave) technology had been challenging to be of practical use in mobile devices, mainly due to limited coverage and being overly costly to implement. However, with many of these technology barriers having been overcome, 5G mmWave is now a commercial reality in smartphones as the complexity of integrating it into smartphones has been addressed through the use of an evolved system approach and a fully integrated Radio Frequency (RF) module design.” That’s a long way of saying that smartphones use modem chips. Phones don’t use RF modules, which find use in IoT devices. Modules are too big for phones.

Some people are betting their life savings on mmWave. Reza Rofougaran, CTO and co-founder of Movandi along with his sister Maryam, are among them. Reza distributed five predictions, though they all revolve around the company’s products. Movandi has focused on bringing mmWave indoors and for private indoor use. Bringing mmWave indoors, however, assumes that outdoor mmWave is available. That may not happen if focus is shifting to mid-band frequencies. According to Reza, “New hybrid private networks and managed service offers using both Wi-Fi and 5G millimeter-wave technologies, gain momentum as a high-performance, flexible, and economic solution for enterprises.”

Another factor that could limit mmWave deployments is 5G and Wi-Fi convergence. Although it might not appear so at first glance, Wi-Fi and mmWave systems are complementary. Wi-Fi networks can support a large number of distributed access points and the fiber backbone connectivity can be expensive.

“Millimeter-wave networks can be used for ‘wireless fiber’” continued Rofuraran, “operating in the unlicensed 60 GHz and licensed 24/28/39 GHz spectrum to replace expensive fiber for backhaul while also providing broader coverage in the fronthaul, especially in large buildings, stadiums, and shopping environments. Together, this hybrid ‘WiFive’ approach brings the unique characteristics and massive available bandwidth of millimeter-wave frequencies together with the huge installed base of Wi-Fi devices to allow gigabit speeds and lower latency to be achieved at very low cost.”

The movement to get the FCC to open a 500 MHz swath of bandwidth at 12 GHz might go where mmWave can’t — provide more bandwidth than is available below 6 GHz with enough range to make it feasible. The push is on.

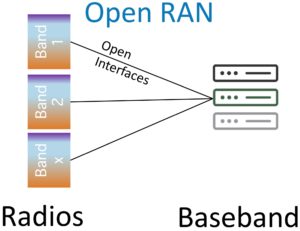

Open RAN

Open radio access networks (Open RAN) have been the most over-hyped aspect of 5G that consumers don’t care about. (Open RAN is the disaggregating of the RAN into software-based components.) Industry talk at conferences says that Open RAN will appear in earnest during the second half of this decade. That’s why the industry soothsayers have already written off Open RAN. Some, however, question that conclusion, at least in the years following 2022.

Open radio access networks (Open RAN) have been the most over-hyped aspect of 5G that consumers don’t care about. (Open RAN is the disaggregating of the RAN into software-based components.) Industry talk at conferences says that Open RAN will appear in earnest during the second half of this decade. That’s why the industry soothsayers have already written off Open RAN. Some, however, question that conclusion, at least in the years following 2022.

“Open RAN will go from pilot to production,” predicted Stephen Douglas at Spirent Communications. “Another incremental change in the coming year, Open RAN will move from small-scale pilots to small- and medium-size live deployments. Based on testing, we expect to see early Open RAN deployments in three key areas: rural regions, indoor, and non-dense urban deployments. All three are viewed as less risky than other types of deployments, either because they will not support mission-critical services, or because they will be able to fall back on the traditional macro network if needed. Some challenger service providers (Rakuten, DISH Network) may start rolling out live Open RAN deployments in denser urban areas, but the major incumbents likely will hold off until 2023/2024.”

For 2022, ABI Research casts a cloud over open RAN. “Open RAN will continue to be deployed across the world, but mobile operators will start paying more attention to RAN Intelligent Controller (RIC) and Service Management and Orchestration (SMO) platforms, as these can be deployed in brownfield networks.”

“2022/2023 will be the focal year of 5G disaggregation and integration,” said EdgeQ CEO Vinay Ravuri. “Expect the major hyperscale cloud providers to cloudify 5G Open RAN. Telco operators, such as Rakuten Symphony, are deviating from traditional telco operating models by experimenting on a similar cloud approach.”

Critical enablers,” continued Ravuri, “will need to be realigned to enable mass adoption of Open RAN.” He bases this on the “availability and maturity of the full stack (L1 and L2/L3)” and with “integration of the full RAN stack and hardware.”

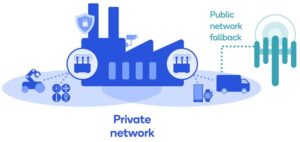

Private networks

At conferences that cover 5G Advanced or 6G, you’ll hear about how 5G is for business applications such as IoT, and factory automation. That’s where private networks play a role. Operating with 5G and 4G, private networks typically transmit and receive in the mid-band.

At conferences that cover 5G Advanced or 6G, you’ll hear about how 5G is for business applications such as IoT, and factory automation. That’s where private networks play a role. Operating with 5G and 4G, private networks typically transmit and receive in the mid-band.

EdgeQ’s Ravuri says “5G offers new capabilities and properties will ignite imaginative possibilities for new end markets that extend beyond traditional telco environments. Governments and national defense companies will look to develop and deploy fully custom, private 5G networks. Smart factories, warehouses, and seaports will capitalize on robotic automation with private 5G networks enabled by AI.”

According to Ravuri, a “tsunami of new connected devices will dwarf smartphones and test the pluralities of 5G.”

In its report, ABI Research claims “Enterprise 5G Will Not Gain the Desired Market Traction in 2022.”

The report states, “Enterprises are looking at 5G for two reasons. First and foremost, Time-Sensitive Networking (TSN) will allow for millisecond latencies, and five-nines availability and reliability of network coverage. Second, deterministic networking protects the enterprise network from unauthorized access or interference.”

The report continues by saying “All these capabilities are standardized within 3GPP Release 16, which enterprises have been eagerly awaiting. While the 3GPP froze Release 16 in mid-2020, Release 16-capable devices are still not entering the market, and we will likely have to wait until 2023 to see any noticeable announcements. In addition, the telco industry still has a long way to go in designing appealing enterprise 5G offerings that consider industry-specific requirements. The telco industry must, therefore, understand that the window of opportunity for enterprise 5G is closing, as enterprises are considering non-cellular technology alternatives.” The report doesn’t, however, specify which technologies might eclipse 5G in the short term.

Here we have more short-term thinking from the analyst community. Everyone wants everything right now, but everything takes time to develop. Let’s see what ABI Research has to say about this next year if they follow up at all.

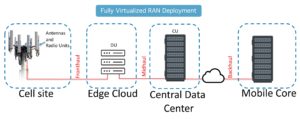

Edge computing

First, we heard about how we needed to move our computing offsite to the cloud. Now, we hear about moving computing out of the cloud and closer to us but not all the way back. It’s all about latency and getting faster turnaround.

First, we heard about how we needed to move our computing offsite to the cloud. Now, we hear about moving computing out of the cloud and closer to us but not all the way back. It’s all about latency and getting faster turnaround.

Spirent’s Stephen Douglas sees edge computing coming, but not fast enough for the analysts. He said “2021 saw the first fledgling edge cloud partnerships between operators and cloud providers or other third parties. In 2022, we’ll see these initial test runs get serious business attention and investment. Look for private cloud-hosted edge offerings for enterprise and industrial use cases.”

With an engineering background, Douglas understands that it takes time to develop the needed products and even more time for people to move to new technologies. That’s something the business community either doesn’t understand or is simply too impatient for things to happen.

ABI Research says “The Exponential Boom in Edge Computing Will Not Come to Fruition.” It will, but these things take time, which nobody wants to take.

“Edge computing, both Mobile-Access Edge Computing (MEC), and general edge computing, will continue to increase in deployment numbers, but the deployments in 2022 will be mostly critical ones made by early adopters and not the start of the boom that is eagerly forecast. Edge computing use cases and financial

viability are tightly coupled to 5G cellular networks, both public and private. The availability of affordable 5G services on which edge computing will thrive is not yet a global reality. As a result, edge computing adoption will be slower than anticipated.”

AI/ML and 5G

I’ve been hearing about AI/ML applications for 5G for several years. The combination started in the research community where it was used to model radio channels and develop signal-processing algorithms for 5G radios. Today, it’s more about using AI for network optimization and for business applications. I expect to see AI/ML make a return to radios as the wireless industry develops 6G. That won’t happen in 2022.

Spirent’s Douglas said “Based on testing, we see significant growth in AI/ML and automation to enhance network performance and fault management. In particular, more operators are investing in active testing and assurance systems to inject synthetic traffic into their networks to emulate real users and services, instead of relying on static, passive probes. And they’re seeking to pair these systems with AI/ML algorithms that can make good decisions in real time for where, when, and what to actively test to improve services or isolate faults, without requiring human intervention. We also expect to see early efforts in using AI/ML to enhance security, and in running testing workloads from public cloud.”

EdgeQ’s Rasvuri said “The convergence of 5G and AI will become more indispensable and value oriented. Enterprises will expect 5G and AI to be seamlessly integrated as a key value center of 5G deployment. This will include the use of AI for advanced network automation and for intelligent analytics to streamline operations, optimize network performance, and drive greater efficiencies overall. These capabilities will be important in the deployment, management, and operation of 5G.”

In its report, ABI Research had nothing to say about AI working with 5G. The report focused on AI regulation, computing methods, and AR/VR.

On to 2022

With 3GPP Release 16 in the books, Release 17 well on its way, and Release 18 taking form, we’ll see 5G adding more features for IoT and industrial use. Products that take advantage of Release 16’s features will begin to appear as engineers develop them. Engineering development time continues to shrink. Still, product development won’t happen fast enough for the analysts. Let them try designing products and see what it takes.

There is no doubt 5g will roll out and 2022 will play a vital role in 5g technology. Although in 2021

5g home internet

was already offered in some cites of USA. But this year it will rise more and more. And I’m looking forward to it.