A report by Information Gatekeepers (IGI Group) says that the two largest U.S. carriers are not spending enough on 5G rollout. That’s what author Clifford Holliday told 5G Technology World.

In Analyst: 5G is all about the traffic, telecom industry analyst Clifford Holliday explained how 5G must acquire the traffic from 4G LTE because LTE networks are choking under the strain from video. Since 5GTW published that article, IGI Group has published 5G 2020: What’s Real? What’s Smoke? What’s Mirrors?, a report on the state of 5G. We spoke with Holliday about his findings.

Holliday’s report looks at the three initial use cases for 5G:

- Enhanced mobile broadband (eMBB)

- Ultra reliable, low-latency communications

- Massive machine-type communications (mM2M)

So far, eMBB is where all the hype is focused. After all, people need to download movies faster right now, don’t they? “There’s a crying need for traffic relief that 5G needs to address,” said Holliday. He argues that carriers need to make money from their investments in 5G eMBB before the other two use cases become reality.

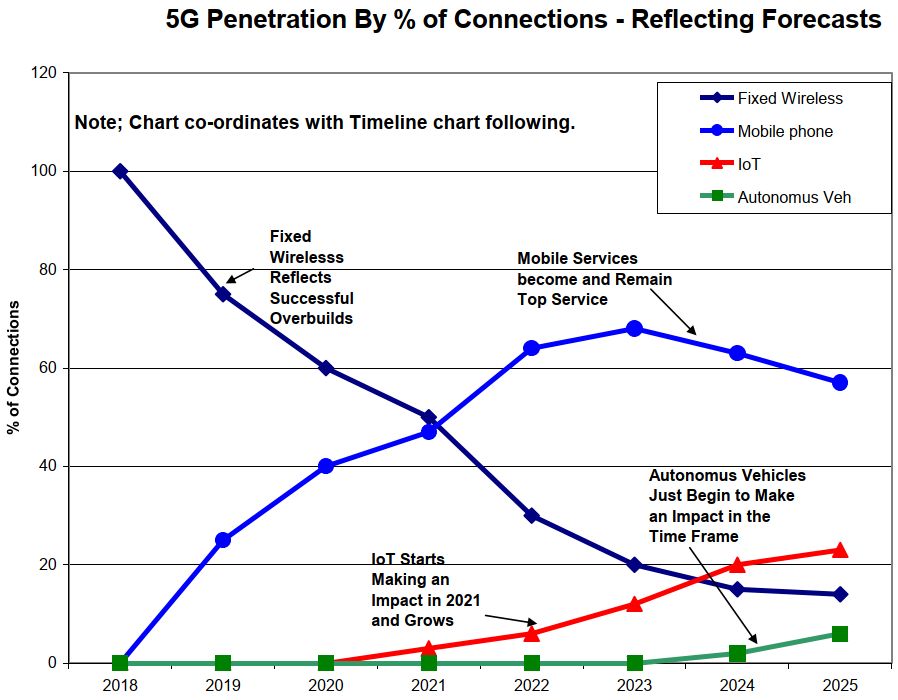

James Blackman noted in December, “Industrial 5G is the only version of 5G that should be considered to be ‘game changing.’” Industrial IoT (IIoT), vehicle-to-vehicle (V2V), and vehicle-to-infrastructure (V2I) communications will come about only when URLLC and mM2M applications become reality. Holliday notes that these use cases won’t happen until the carriers recoup their buildout investments. But, there’s a problem: buildouts cost huge amounts of money. That money will have to come from subscriber fees and consumers are reluctant to pay more for their data. Further, Verizon and AT&T are not increasing spending on 5G buildout. In fact, AT&T is cutting back expenditures from $23.7 billion to $20 billion. Thus, Holliday argues in his report that the big-impact applications will be slow to rise, and not until 2022 and 2025, respectively (Figure 1).

Figure 1. According to the report, IoT and autonomous vehicles need the 5G infrastructure that first comes from mobile services.

Image courtesy of Information Gatekeepers.

“5G has got to be the solution for the traffic,” said Holliday. “It must offload traffic from 4G because the 4G networks can’t handle it. It’s a problem in major cities. The issue is video.”

What will it take to get eMBB to take traffic from LTE?

Because it’s all about traffic relief, 5G needs not only the supporting infrastructure, it needs to support eMBB both outdoors and indoors. But, most commercial buildings block mmWave signals. “We need the development of indoor 5G. 5G needs to work everywhere.” Thus, the 5G infrastructure need network connections that are reliable and efficient. “It needs to work everywhere just like 4G does now. It’s useless to be outside, then go indoors and your service drops to 4G. We need high speed interior 5G. Low-band (600 MHz – 700 MHz) works well, as does mid-band (2.5 GHz – 7 GHz).”

From the outside, it seems Samsung is more interested in the Galaxy S20’s camera than in its 5G capability.

According to the report, we will also need cross-band phones to truly take advantage of 5G. “Traffic can’t fall back to 4G in areas where we don’t have high-quality 5G signals.” That, according to Holliday, defeats the purpose of offloading traffic. Phones will need to seek the highest speed 5G connection that’s available. If speed drops because of signal strength, phones need to switch to next slower 5G signal. When no mmWave service is available, a phone should switch to low-band 5G, but not to 4G. That kind of phone isn’t available, according to Holliday.

Holliday noted that Samsung has taken an initial step in that direction with the Galaxy S20 (Plus and Ultra). The company’s latest phones can handle most 5G bands worldwide, but they don’t do what Holliday says is needed. He noted, however, that with the right SIM card, the phones can operate on AT&T mmWave, T-Mobile 600 MHz band, Sprint mid-band, and can go to numerous countries. They don’t, however, automatically shift bands to keep data on the 5G network. “Now I read that Apple might not even introduce a 5G phone this year at all. When they do, that phone will only be low-band, which is just a little better than 4G,” said Holliday. “We need a step-down, fall back phone. We also need the networks to support them.”

mmWave not enough

“AT&T and Verizon will need both high-speed mmWave and lower frequencies to be useful,” said Holliday. “They need the step-down network in 5G to lower frequencies. Right now, they don’t have low-band 5G. AT&T is talking about it, but we haven’t seen it. Verizon isn’t even talking about it.”

The merger of Sprint and T-Mobile will help solve the indoor/outdoor problem because Sprint is using 2.5 GHz while T-Mobile is touting 600 MHz. Even that combination won’t provide the data rates available at mmWave frequencies, but it’s better than 4G. But, you need a phone that can handle all of those frequencies. “We still need cross-band phones,” said Holliday.

Will low-band with large antennas affect the size of phones and will people tolerate it? The report says, “we need a miracle.” Samsung has, according to Holliday, addressed that by claiming its phones will work on lower bands but it still lacks the fallback capability. You can’t however tell that from Samsung’s published specs, which say only “5G Non-Standalone (NSA), Standalone (SA), Sub6/mmWave.”

Holliday added that Verizon is working with Boingo Wireless on a distributed antenna system that would work with major buildings. “This distributed antenna system might be the answer. It all ties back to having real 5G traffic that doesn’t fall back to 4G.”

Having 5G work with other wireless networks in public spaces helps with some of the traffic problem, but what about 5G in residential areas? Deployment of small cells brings up practical issues. “How do you lay out the fiber?” asked Holliday. “We need design parameters and best practices for laying fiber, lots of fiber. 5G is as much a fiber network as a radio network.”

Software is another issue. Adding all those small cells increases complexity of the software control plane. “Should we have a mesh network?” asked Holliday “What if a node is wiped out when a pole gets hit? These are the real deployment issues.”

Holliday went a step further noting that the report addresses support systems such as planning support, practices, and parameters for fiber and antennas.

Then there’s operations support and maintenance. People at the central office need network monitoring to know when and where problems occur and who to send into the field to fix them. You need that support to give operations people the tools. That issue is starting to be addressed.

What about other applications such as IoT and mM2M? They seem to be the game changers, if they ever happen.

“You must have the network first, said Holliday. “The carriers need to solve the traffic problem so that 5G makes money and can support the other use cases. Carriers won’t get there until they sell more 5G traffic.” Indeed, autonomous vehicles may not need 5G at all. Holliday noted that auto makers have added cameras, radar, sensors, and software to the point where cars will stop if the detect a person behind you and self-parking cars are now a reality.

In summary, Holliday notes that AT&T and Verizon aren’t investing in 5G to keep up with the hype. “The two carriers are blowing smoke. They are not prepared to spend the money that’s needed. It’s questionable if the two are going to go with 5G.”

“They can’t figure out how they will get paid for it. They don’t see how to recover the investment. The business and manufacturing needs could do that, but the infrastructure needs to be there first. Part of recovering the investment is getting people to pay for 5G. There needs to be a way for the carriers to get paid for the 5G investment.”

As a wireless user, will you pay more for 5G? Many will, but many won’t. For those of us who don’t download movies using cellular data, we see LTE as fast enough.

AT&T is cutting jobs, mostly because of software defined networking (SDN).

https://www.sdxcentral.com/articles/news/att-puts-more-jobs-on-the-chopping-block/2020/03/

In some IoT cases, fallback can go to 3G and even 2G. Are you designing 5G into IoT? If so, we want to hear from you.